Adulting really is a thing that is happening whether we like it or not. As I slowly but surely come to terms with this, I've realized that one thing I have to consider is the importance of a savings account. Like a real real savings account.

I know, sometimes we feel overwhelmed just staying above water with our bills, because at times that can be a struggle in itself. But a savings account can make or break your entire money situation, and life, when the unexpected happens; or even if you just want to save for a major life event like buying a car or a house. While it's a big deal, it's not as hard as it sounds. The biggest obstacle is pressing "go" and getting started.

Thankfully, we've come across a few savings challenges that not only make it easy but prove that putting a little away each week or month can help you save more than $1,000 in a year.

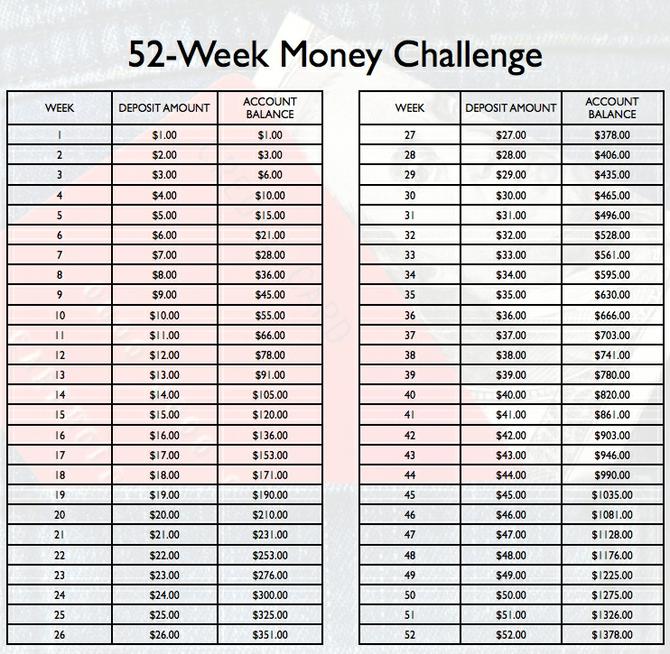

1. The 52-Week Challenge:

If you're like me, it's really easy to feel all motivated and inspired to start saving, but when it comes to actually doing it, it can feel a little overwhelming because I might not have a couple hundred dollars on hand to jumpstart the process, so it's hard to start to begin with. That's why I love this 52-week money challenge. It lasts a year (clearly) and by the end of the timeframe, you would have saved almost $1,400! And it's really just starting with a little bit at a time and gradually growing the amount you save.

SaveALoonie

For the first week, you save $1, for week 2, $2, and so on… so for week 29, you save $29, for week 52, you save $52. Just like with all of these challenges, sticking with it is the major key to seeing the results you want.

2. That Every Other Week Challenge:

Most (if not all) of us get paid every other week. It's the nature of working a full-time job, so I completely understand why saving every week might not be the best challenge for you. If you get paid bi-weekly, I think payday is the best time to save because that's when the momentum is lit. You might feel like you're ballin' and can throw some money into your savings account before you let other expenses eat it up.

You can do the 52-week challenge your own way and only save on payday instead of every week; just double the amounts per week (so for week 1, save $2 and for week 2, save $4, and so on) to still reach the nearly $1,400 you would get with the 52-week challenge.

3. The $20 A Week Challenge:

I can't help but reiterate that the focus of these challenges is doing a little bit at a time. $20 a week might sound like everything to you or nothing, but it can be done if you take the initiative. For me, I've thought there's no way I'll have $20 leftover at the end of the week. But once I realized how much I was spending on food and other unnecessary items just for leisure, I found out I could actually save more than $20 a week if I really wanted to be that disciplined.

The best part is, once you start challenging yourself and see your savings account start stacking up, you'll want to save even more. At the very least, if you save $20 a week for a year, you'll end up with more than $1,000 in your savings. If your goal is to save more, decide how much you want saved within a certain time frame, divide it by the weeks and boom, that's how much you need to save per week.

4. A Penny A Day...

…Can help you save almost $700. It's not $1,000, but I had to throw this one in there because it's so easy, you might even be able to do it along with one of the challenges on here. You literally start with one penny a day and save an extra penny for each day after that. So day 1 is one penny, day 2 is two pennies, day 3 is three pennies, and so on and so on. By the end of the year, you would have saved $667.95.

I know it's extremely tedious to try and find pennies, because who really carries change like that? You can either transfer it to your savings from your checking or just save a larger amount than a penny, so it doesn't get annoying. You can also save by the week using this chart if to you a penny a day is really doing the utmost.

5. It's The First Of The Month

Yes, if saving daily, weekly, or bi-weekly is too much to remember, there's also a monthly challenge that will get you almost $1,100 a year. With this challenge, you can set a reminder on the first or whenever your initial payday of the month is to put an amount into your savings. The only thing with this one is that since it's monthly, you'll have to save more each time compared to the other challenges.

For the first month you save $25, the second you save $50, the third you save $75, and keep adding $25 until the six month, where you'll save $150. Then you channel your inner Missy Elliott and reverse it for the rest of the year. The seventh month you save $150 again, $125 in the eighth month, $50 in the eleventh month and $25 for month 12. By then, you'll have $1,050. It's definitely tedious but when you challenge yourself and make it fun, you'll start a new habit that can stack your account without a question.

6. No Spending Challenge

Even though stacking your savings account is an obvious and easy way to save, that's not the only way to partake in a savings challenge. You can also challenge yourself not to eat out for a week and put what you normally would spend on a restaurant (even if it's just McDonald's) in your savings account. You can save money by setting a budget for everything you do from grocery shopping to gas, and any portion of that allotted amount you don't spend can get dropped right in that savings.

Ultimately, it's really up to you what you're willing to give up or sacrifice for the sake of stacking your savings account. Thankfully, it's really not that bad once you get going.

The key is to keep the momentum until you reach your goal.

Featured image by Shutterstock

Originally published December 28, 2018.

- 11 Money Challenges to Try When Saving Sucks ›

- Top 10 Fun & Easy Money Savings Challenges for 2019 ›

- 5 New Year's money challenges to save more in 2018 | Clark Howard ›

- 8 Savings Challenges You Can Use To Save More in 2018 ›

- 10 Money Saving Challenges to Start Today! ›

- 4 Money Saving Challenges for Small Budgets - The Budget Mom ›

- 5 Money Saving Challenges to Try | Budgets Are Sexy ›

- 7 Fun Money Saving Challenges to Try in 2018 ›

- 10 Money Saving Challenges To Kick-Start Your New Year - The ... ›

- 8 Different Money Saving Challenges to Try | Young Adult Money ›