6 Savings Challenges That Will Take Your Account From $0 To $1000 Real Quick

Adulting really is a thing that is happening whether we like it or not. As I slowly but surely come to terms with this, I've realized that one thing I have to consider is the importance of a savings account. Like a real real savings account.

I know, sometimes we feel overwhelmed just staying above water with our bills, because at times that can be a struggle in itself. But a savings account can make or break your entire money situation, and life, when the unexpected happens; or even if you just want to save for a major life event like buying a car or a house. While it's a big deal, it's not as hard as it sounds. The biggest obstacle is pressing "go" and getting started.

Thankfully, we've come across a few savings challenges that not only make it easy but prove that putting a little away each week or month can help you save more than $1,000 in a year.

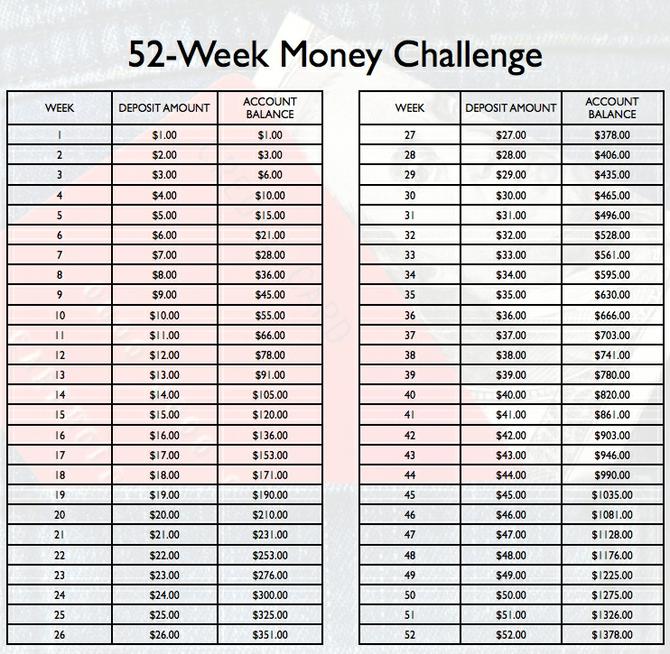

1. The 52-Week Challenge:

If you're like me, it's really easy to feel all motivated and inspired to start saving, but when it comes to actually doing it, it can feel a little overwhelming because I might not have a couple hundred dollars on hand to jumpstart the process, so it's hard to start to begin with. That's why I love this 52-week money challenge. It lasts a year (clearly) and by the end of the timeframe, you would have saved almost $1,400! And it's really just starting with a little bit at a time and gradually growing the amount you save.

SaveALoonie

For the first week, you save $1, for week 2, $2, and so on… so for week 29, you save $29, for week 52, you save $52. Just like with all of these challenges, sticking with it is the major key to seeing the results you want.

2. That Every Other Week Challenge:

Most (if not all) of us get paid every other week. It's the nature of working a full-time job, so I completely understand why saving every week might not be the best challenge for you. If you get paid bi-weekly, I think payday is the best time to save because that's when the momentum is lit. You might feel like you're ballin' and can throw some money into your savings account before you let other expenses eat it up.

You can do the 52-week challenge your own way and only save on payday instead of every week; just double the amounts per week (so for week 1, save $2 and for week 2, save $4, and so on) to still reach the nearly $1,400 you would get with the 52-week challenge.

3. The $20 A Week Challenge:

I can't help but reiterate that the focus of these challenges is doing a little bit at a time. $20 a week might sound like everything to you or nothing, but it can be done if you take the initiative. For me, I've thought there's no way I'll have $20 leftover at the end of the week. But once I realized how much I was spending on food and other unnecessary items just for leisure, I found out I could actually save more than $20 a week if I really wanted to be that disciplined.

The best part is, once you start challenging yourself and see your savings account start stacking up, you'll want to save even more. At the very least, if you save $20 a week for a year, you'll end up with more than $1,000 in your savings. If your goal is to save more, decide how much you want saved within a certain time frame, divide it by the weeks and boom, that's how much you need to save per week.

4. A Penny A Day...

…Can help you save almost $700. It's not $1,000, but I had to throw this one in there because it's so easy, you might even be able to do it along with one of the challenges on here. You literally start with one penny a day and save an extra penny for each day after that. So day 1 is one penny, day 2 is two pennies, day 3 is three pennies, and so on and so on. By the end of the year, you would have saved $667.95.

I know it's extremely tedious to try and find pennies, because who really carries change like that? You can either transfer it to your savings from your checking or just save a larger amount than a penny, so it doesn't get annoying. You can also save by the week using this chart if to you a penny a day is really doing the utmost.

5. It's The First Of The Month

Yes, if saving daily, weekly, or bi-weekly is too much to remember, there's also a monthly challenge that will get you almost $1,100 a year. With this challenge, you can set a reminder on the first or whenever your initial payday of the month is to put an amount into your savings. The only thing with this one is that since it's monthly, you'll have to save more each time compared to the other challenges.

For the first month you save $25, the second you save $50, the third you save $75, and keep adding $25 until the six month, where you'll save $150. Then you channel your inner Missy Elliott and reverse it for the rest of the year. The seventh month you save $150 again, $125 in the eighth month, $50 in the eleventh month and $25 for month 12. By then, you'll have $1,050. It's definitely tedious but when you challenge yourself and make it fun, you'll start a new habit that can stack your account without a question.

6. No Spending Challenge

Even though stacking your savings account is an obvious and easy way to save, that's not the only way to partake in a savings challenge. You can also challenge yourself not to eat out for a week and put what you normally would spend on a restaurant (even if it's just McDonald's) in your savings account. You can save money by setting a budget for everything you do from grocery shopping to gas, and any portion of that allotted amount you don't spend can get dropped right in that savings.

Ultimately, it's really up to you what you're willing to give up or sacrifice for the sake of stacking your savings account. Thankfully, it's really not that bad once you get going.

The key is to keep the momentum until you reach your goal.

Featured image by Shutterstock

Originally published December 28, 2018.

- 11 Money Challenges to Try When Saving Sucks ›

- Top 10 Fun & Easy Money Savings Challenges for 2019 ›

- 5 New Year's money challenges to save more in 2018 | Clark Howard ›

- 8 Savings Challenges You Can Use To Save More in 2018 ›

- 10 Money Saving Challenges to Start Today! ›

- 4 Money Saving Challenges for Small Budgets - The Budget Mom ›

- 5 Money Saving Challenges to Try | Budgets Are Sexy ›

- 7 Fun Money Saving Challenges to Try in 2018 ›

- 10 Money Saving Challenges To Kick-Start Your New Year - The ... ›

- 8 Different Money Saving Challenges to Try | Young Adult Money ›

Charmaine Patterson is a journalist, lifestyle blogger, and a lover of all things pop culture. While she has much experience in covering top entertainment news stories, she aims to share her everyday life experiences, old and new, with other women who can relate, laugh, and love along with her. Follow Char on Twitter @charjpatterson, Instagram @charpatterson, and keep up with her journey at CharJPatterson.com .

We have less than 40 days left in 2024, and while I'm not one to rush goals just because it's the end of the year, it can be fun to challenge yourself to think about ways you'll close out this year big.

Whether you're planning to meet a certain financial or fitness goal, or you're simply trying to maintain and build on the progress you made this year, having something to look forward to is always a good look. Setting actual goals, according to research, actually leads to more success than just playing things by ear. So here are a few to get you started, sis:

(Disclaimer: Not everything is for everyone, so do like my Granny always says: "Eat the meat. Spit out the bone." Take on five out of the 40 and focus on that for the remainder of the year, or do them all. Either way, this is just to get you started.)

40 Ways To End The Year Strong and Inspired

Money Moves

Riska/Getty Images

1. Increase your retirement (or other savings/investment) contributions by 1%.

Experts have found that you could be leaving money on the table by not upping your contributions when you can.

2. Cancel two to five subscriptions.

You could be missing hundreds, even thousands, of dollars a year due to sneaky price hikes and "updates."

3. Create a "fun" in a high-yield savings account.

This is especially important if you struggle with the dreaded b-word (budget) and will make next year's efforts a lot less intimidating. Even if it's $10 a month, do it.

4. Put on your big-girl panties, and set up automatic transfers and payments for at least one bill.

It reduces the stress of managing bills, lessens the chance of a missed payment---and the fees that come with that---and there can be cost savings for doing so.

5. Invest in a cleaner or housekeeping service.

Bosses who value their time (and mental health) invest their dollars into areas where the time they'd spend doing those tasks themselves could be better used to focus on other money-making projects. (And yes, rest is part of that.) Get a housekeeper, sis, or drop off that laundry, even if it's once per month.

6. Donate to a charity.

Beyond the tax benefits, it's a win-win for the greater good of communities you care about.

7. Review your insurance policies and negotiate a better rate (or move on) before their end dates.

Experts often agree this is a small but mighty step to take each year, especially since insurance rates are competitive, you could be spending more money than you need to (or not enough) and your insurance rates can affect your mortgage payments.

8. Call your loan provider and refinance.

As interest rates fall, “millions of borrowers may be able to refinance and get more affordable payments. As interest rates eased down to 6.5%, about 2.5 million borrowers could already refinance and save at least 75 basis points (0.75%) on their interest rate,” the Consumer Financial Protection Bureau reports. You can also refinance student and other types of loans.

9. Stop buying individual items and stock up via going bulk.

Research has found that, among 30 common products, buying in bulk could save you 27% compared with buying in lower quantities. Water, paper products, and baby products like diapers, toiletries, and garbage bags are the top items where people see the most cost-effectiveness. (This has been a lifesaver for me—children, large family, or not—especially when it comes to toothpaste, deodorant, toilet paper, and feminine hygiene products, saving stress, time, and money.)

10. Go cash-only for the holidays.

If you set smart goals and stick to limits on things like gifts, going out to eat, or groceries, you'll see the benefits of this. Cash-stuffing is one method recommended, but something as simple as taking a $10 bill out for lunch, disabling that card for an hour, and leaving your card in a safe place at the office can give you that mindset jump start to see how far you can take your money without the need to splurge.

Love And Romance

11. Say "no."

There are clear mental and physical health benefits to saying no including the setting of healthy boundaries, creating time and energy for other self-care activities, and protecting yourself from physically harmful situations (i.e. unprotected sex or abuse). Just say it, clearly and simply, when you need to.

12. Set a fun, free, adults-only date night for once a week or twice a month with your spouse.

If busy, high-profile folk have touted the success of this, even you can make the time for quality time with your partner. And it's even better when it costs nothing. The best connections are made doing something chill, challenging, or outside the usual dinner-and-a-movie date. Play a game that allows you to reconnect, take a walk in your neighborhood to chat and laugh, or try a little erotic chocolate/edible liquid/paint episode a la Mea Culpa.

13. Go out with Mr. or Ms. "Not My Type."

I love my man, but if I were waiting out for my "type" at the time, we wouldn't be celebrating seven (going on eight) years together. Sometimes having strict, unrealistic expectations for a spouse (especially related to things like height, physical features, or career path) is what's keeping you alone and lonely.

Take the pressure off and explore all your options. I'm not telling you to stop popping the balloon on the guy who earns $20,000 less than you if that's a hard no that Jesus himself told you to skip. I'm asking you to explore other options and see what else God might have out there for your love journey.

14. Immediately apologize and pray together.

I've learned that always being "right" isn't always ideal when you truly care about someone and you're in a relationship for the long haul. Defaulting to an apology when necessary, even when things aren't 100% resolved, is a good way to prioritize peace and save your energy for more worthwhile battles. Research has even supported the benefits of apologies in relationships, and how couples married for five or more years do it often.

15. Get a Rose and discover true self-love.

Do I really have to explain this? You've gotta know what satisfies you, and how better to figure that out than to practice self-love in the bed by yourself? You can also try this with a partner, but as a woman who got on this train very much later in my sexual activity journey. I have a lot more learning to do on my own, and even in a satisfying relationship, I like to find out new things about myself, by myself.

Figure out what you're into, watch what you want to watch, and read what you want to read to define pleasure for yourself. There's a freedom and empowering element there especially if you're used to prioritizing pleasing your partner.

16. Be direct and have the "money talk" with bae.

Money issues are one of the leading causes of divorce, so you need to have those conversations before you even think about marrying someone. And true, nobody can predict the future so you won't be able to avoid some challenges altogether, however, talking with your potential spouse about how they view money, their spending habits, and the pain points in terms of their approach to money management can at least give you a glimpse into what's in store if you do walk down the aisle, move in with them, or decide to share a bank account/business/child with them.

17. Invest in the "paid" version of that dating app.

I know plenty of successful, married folk who did this and met "the one" as a result. Let's be honest: The free version is for playing around. I had a lot of fun with my "free" profile back in the day, trust me. Upgrade that photo, profile, and package, and see if the quality of your dating adventures changes when you're serious about finding a true partner. Dating coaches and matchmakers cosign this.

18. Solo travel to meet that long-distance connection.

Sometimes, your perfect match isn't within 100 miles of you, and that's okay. Make it an adventure, enjoy the memories, and book that ticket. I met my man this way and it's been a whirlwind escape ever since. If you're not comfortable traveling solo, travel or (network to plan travel) with a group via Facebook.

Career And Business

Riska/Getty Images

19. Schedule coffee or virtual meetups with smart people from your graduating class, previous employer, or current employer.

I have gotten many freelance opportunities by doing this. It's as simple as connecting and offering value (or simply learning how you can better equip yourself to do so.) It's also a great way to expand your network, spark new friendships, or find out about new job opportunities.

20. Invest in a well-made suit.

I don't care what industry you're in, a suit says "power," and it's not as old-school or out-of-style as you'd think. Plus the whole experience of looking for a new one (or getting one tailored) is fun and affirming. Try these options. I swear, anytime I wear a blazer, I'm treated like a celebrity or boss, especially when traveling. I was once upgraded to first-class wearing a yellow blazer outfit, and the airline professional literally said, "You look like somebody important. Here you go."

21. Volunteer for a worthwhile project or cause that's important to your company.

If you're overworked and underappreciated, skip this one, but if you truly have the time, love what you do, and want to advance, this move is clutch. Volunteering for extra projects got me where I am today in media because I had foresight, and knew that was the only way at the time to leverage relationships, and I was able to challenge myself to learn skills that 20 years later are still bankable. That VP you can't get a meeting with will be at that gala your company is planning, so join that committee, sis.

22. Write down why you deserve a raise and ask for it in your next one-on-one.

Gather those receipts (ie sales increase numbers, KPIs met, deals closed, people acquired via recruitment, the impact of systems updates, or other tangible success metrics) and ask for that raise before the first or second-quarter budgets are being finalized.

23. Instead of quitting, write down your exit plan.

While revenge quitting is set to be a thing next year (and maybe you're among those who will be leading the trend), try the better boss move and quit with a real plan.

24. Start automatically separating that estimated self-employed quarterly tax estimate.

If you have side hustles (or you're collecting 1099 income,) baby, you do not want to neglect those quarter tax payments. Talk to a professional, do your research, and set up automatic transfers to an account specifically for paying these at the appropriate due dates.

25. Sign up for a free one- to 11-week course related to your industry—or the industry you want to be in next year.

Institutions like Harvard University and platforms like Coursera offer free courses that can enhance your skills. You can also invest in certificate courses with accredited colleges as well as tech training.

26. Hit "Easy Apply" for 10 dream jobs listed on LinkedIn.

While you shouldn't solely rely on this when actively job-seeking, using this convenient LinkedIn option is a great way to get into the habit of applying for positions. And if you're already employed, you should still be "dating" other employers if you're looking to make a move in the next six months. Keep your interview skills sharp, practice toughening up for the "nos," and get a bit of an ego boost in the process.

Self-Care And Wellness

27. Pre-schedule three month's worth of massages.

Oftentimes this is cost-effective since some spas offer deals for multiple bookings. Also, it makes an act of self-care deliberate and important, not an option. When you get that reminder call, you'll know it's real.

28. Fire that therapist and try another one.

Cultural competency in mental health support is one major problem that can hinder Black women from even bothering with therapy. And who wants the added stress of spending multiple, paid sessions explaining why something is a microaggression? Cut the cord and move on to try someone else, either via a Black women therapists channel or recommendations from others.

29. Join a small group at church.

Bedside service ain't gonna cut it and neither is going to the usual Sunday service. Join a smaller group and upgrade your efforts to connect, network, and elevate spiritually. Even if virtually, take a step to dig a bit deeper with more targeted Bible study and discussions.

30. Say no, even to loved ones.

This is on here twice, for a reason. Saying no is the simplest, most powerful micro-action you can take today to make 2025 better. No explanations. No guilt. Say no.

31. Choose one "luxury" beauty product for skincare and stick to it.

This was trending big on social, especially for millennials hitting their 40s. There's just something so freeing about not giving in to every trend and sticking to the basics that work, especially when there are quality, healthy ingredients involved. Put those orders on auto-renew.

32. Sign up for a new sport or fitness class just for fun, not for results.

It's great to be on a weight-loss or weight-lifting journey, but try something just for the fun of it. Switch things up with a couple of these fitness activities.

33. Book a staycation.

Leave the passport at home and explore a nearby community or another town in your state. There's so much enrichment in your own backyard right here in the U.S., and you don't even have to break the bank.

34. Pre-schedule your mammograms, Pap smear, and peri-menopause checkups for next year.

Take control of your health by pre-scheduling essential appointments like mammograms, Pap smears, and peri-menopause check-ups for 2025. Prioritizing these screenings early ensures you stay on top of your wellness and make time for self-care in the new year.

35. Cut off support of beauty and wellness professionals whose customer service is below standard.

This is another one that many Black women have been vocal about—from unrealistic pre-appointment requirements, to booking fees, to long waits, to unsavory in-salon experiences. Spot the red flags early, and just stop accommodating foolishness. Support salons or experienced stylists who are kind, have proper systems in place and value your time.

36. Schedule five to 10-minute moments of silence on your calendar.

Again, wellness is not optional, and if it's not on my calendar, it's not official. Sit quietly. Pray. Meditate. Or do nothing. The benefits of silent moments are almost endless.

37. Download a meditation app.

If you've found that meditation is difficult to schedule or to even start, an app can help. Try this, this, or this one, and take that step to embrace something new to enhance your wellness routine. If you're tired of downloading apps, create a playlist for meditation via Amazon Music or Spotify and schedule a reminder to do it once a day or week.

38. Invest in a healthy meal prep or delivery service.

Time is emotionally expensive, so save as much of it as possible. Getting into meal prep to keep to your goals is a great way to save time, stress, and effort. The health benefits of meal prepping have also been proven via research.

39. Create a positive playlist on Spotify, Amazon Music, YouTube, or other streaming platform.

It can be podcasts, music, affirmations, or somatic sounds. It's a game-changer. You can even set an alarm to wake you up to start your day with the positive playlist. Not into creating your own? There are plenty to choose from with a quick search.

40. Set up reminders for Alexa (Siri or other AI) to remind you, "You are loved," and "You are okay."

This simple effort can boost your endorphins and remind you that you're indeed, not alone, and you will be okay, regardless. To set mine up, I simply commanded, "Alexa, remind me everyday 'Jesus loves me,'" and like clockwork she does. She almost scared the ish out of me one day when I'd forgotten the reminder was active, but it was the reminder I needed when anxiety had gotten the best of me that week.

Let’s make things inbox official! Sign up for the xoNecole newsletter for love, wellness, career, and exclusive content delivered straight to your inbox.

Featured image by

10 Unforgettable Black Film & TV Sex Scenes That Brought The Heat

What makes a sex scene great? Personally, I think it comes down to a combination of things. It’s in the details - the close-ups of skin, eye contact, touch. It’s in the sounds, the dialogue, the chemistry, the location, the context, the taboo, and everything in between.

While the movies and shows on this list vary in genre and style, they all have toe-curling elements that make them truly mind-blowing.

1. Love & Basketball

Now, Love & Basketballis a universally memorable movie in the Black community in its own right, but that sex scene was almost revolutionary. The raw, realistic portrayal of Monica’s first time as she loses her virginity to her childhood soulmate Quincy was an important moment for young Black women everywhere. For a scene that had no on-screen nudity, the chemistry between the characters was enough to have us all feeling a little hot under the collar!

2. Set It Off

This 1996 sex scene between Blair Underwood and Jada Pinkett-Smith’s characters Keith and Stony had all the elements that take a sex scene from good to great. And let’s not let the fact that Jada used a body double take away from how iconic this scene is. Attractive actors, focused foreplay, close-ups, tension-building music (shout out En Vogue!), and chemistry for days. When I rewatched this movie recently and noticed the way Keith moved his chain out of the way (IYKYK), I yelled! Those little details set this sex scene apart.

3. Out of Time

Denzel Washington has been fine his whole life. He’s intergenerational fine. And when this movie came out he was in his PRIME, okay?! The chemistry between Denzel and Sanaa Lathan in Out of Time is undeniable. So much so that when the movie came out, rumors began to circulate that the actors were romantically involved. And if you’ve seen the movie, I’m sure you’re not surprised.

The icing on the cake for me was that roleplay scene (peep the video above). You know, the one where Matthias pretends to be investigating a crime and Ann talks him through what the “intruder” did to her and he reenacts it? Turns out WE were the ones intruding on a crime - assault with a deadly weapon, if you will.

4. Scandal

Thursdays haven’t been the same since ABC’s TGIT. Shonda Rhimes was in her bag when she gave us back-to-back episodes of Grey’s Anatomy, Scandal, AND How To Get Away With Murder. Lives were changed. Aside from nail-biting drama and salacious storylines, Shonda also consistently gave us an array of dangerously attractive characters and sexual tension so thick you could cut it with a knife.

I’ll forever be team #Olitz. Their steamy sex sessions were made even hotter because their relationship was taboo, scandalous, even.

Adultery aside, Olivia and Fitz’s sexy time scenes never left anything to be desired. Interestingly, my favorite Olitz sex scene is their very first time. After six episodes of build-up, they finally did the deed and alleviated all the sexual tension we’d all been feeling. I think we all developed a new level of respect for Fitz when he ordered Olivia to take her clothes off, and she did not disappoint because she served bawdy in that white lingerie (I see what you did there, Shonda). Olivia served at the pleasure of the President, and so did we. For all 6 seasons.

5. Bridgerton

Dearest Gentle Reader, this couple certainly set the Ton abuzz in Bridgerton season one. For a Duke who was once lost for words, the cat’s certainly no longer in possession of his tongue. And luckily, it seems the Duchess is more physical touch than words of affirmation.

The Hastings basked in newlywed bliss all over their new abode and that library ladder scene - you know the one - took the couple’s sex life to new heights. What made this scene with Simon going down on Daphne while she’s suspended on a ladder so incredibly hot is how it centered *female* pleasure. He a good man, Savannah!

6. Insecure

One thing we could always expect from Issa Rae and Larry Wilmore’s hit series - a jaw-dropping sex scene. What I loved about Insecure’s sex scenes is that they’re not only seriously hot, but alsoVERY relatable. From that incident with Daniel, to Issa and Lawrence’s freshly-broken-up-unfinished-business ex-sex.

The one that tops my list has got to be when Issa and Nathan joined their own version of the Mile High Club on the Ferris wheel at Coachella. Cinematically, the scene was gorgeous but it also felt truly organic, like it was the perfect first time for them. I feel like we all collectively exhaled because she finally chose a man we could actually root for. You know what that is? Growth.

Honorable mention: the we’ve-finally-reunited couch sex Lawrence and Issa have when they finally get back together.

7. Power

From gunplay to foreplay, Power held nothing back. Every sex scene was spicy in its own way from Tate and his staffer, to the pilot episode Ghost and Tasha, to Tommy and Keisha. So many to choose from! The one that stands out in my mind is when Ghost and Angela get it on against the window of his hotel room overlooking the New York cityscape. Their chemistry was undeniable and the yearning was palpable in every single one of their sex scenes. Now, that’s acting!

8. Love Jones

WhenLove Jones premiered in 1997, a Black romance about a couple of creatives living and loving in the city was unprecedented. Between the novelty of the story and the charming dynamic between Darius and Nina, Love Jones quickly became a cultural classic. And even with the plethora of Black stories that have since graced our screens, Love Jones is a movie the conversation always comes back to. I mean, with bars like “I’m the blues in your left thigh trying to become the funk in your right”? Yeah, I would’ve folded.

Nina and Darius having sex on the first date felt bold and spontaneous, but that’s only part of why that scene was so steamy. Music can make or break a moment on-screen - sex or otherwise - and Maxwell’s "Sumthin’ Sumthin’" playing in the background made it feel like they were truly making love. Romance is sexy too, right?

9. Queen & Slim

Finally, on-screen car sex that actually looks enjoyable! It’s a beautifully shot scene with long, slow closeups of the characters making intense eye contact (IYKYK!). And the passion between the two actors is so realistic that some people even questioned if the scene was real! The buildup that led to this spontaneous daylight, on-the-run hookup made it even sexier. 10/10, no notes.

For so long, we’ve been starved of seeing positive Black female sexuality on screen and the She’s Gotta Have It remake helped to change that. DeWanda Wise absolutely killed it in the Spike Lee remake as Nola Darling, a polyamorous pansexual woman living her best sexually liberated life, boldly approaching relationships in a way we usually see as taboo. Men, women…one, two, three on rotation, Nola’s pleasure was Nola’s priority (IKDR!).

While her sexual appetite meant her loving bed saw many visitors, I think her best sex scene came when she finally decided to give monogamy a try with her girlfriend Opal. While the scene was pretty graphic, just like the others, this one was different because it was special. It felt like Nola and Opal were two women passionately in love. And what’s sexier than sex with someone you love?

Let’s make things inbox official! Sign up for the xoNecole newsletter for love, wellness, career, and exclusive content delivered straight to your inbox.

Featured image via Netflix