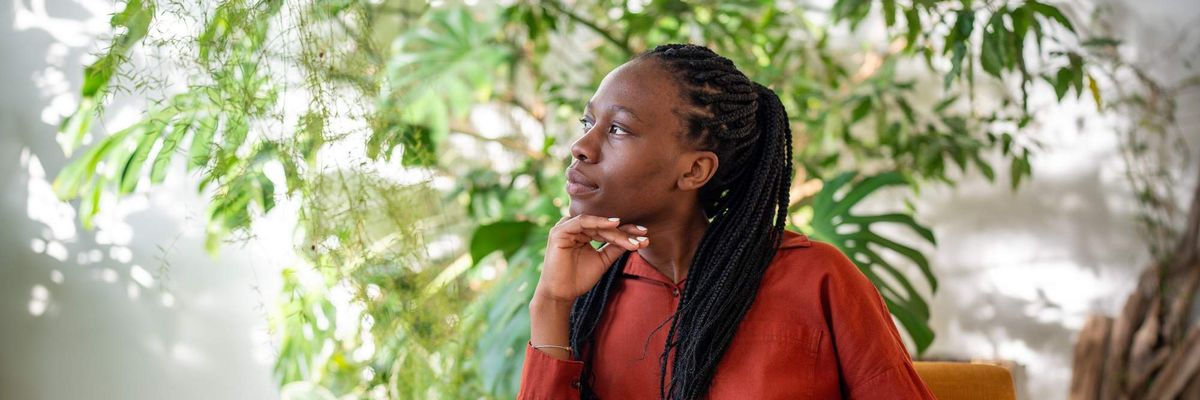

She was on every form of government assistance offered. She was robbing Peter to pay Paul. She was living paycheck to paycheck, with a non-existent savings account and an embarrassing, credit score. Finally, enough was enough. Arnita Johnson was fed up.

“I graduated high school with good credit thanks to my mother, but six months later, I messed it up. I had 25 different credit cards and couldn't keep up with the payments. When you have good credit, credit card offers are literally thrown at you and I believe I got addicted to just being approved. I was working a low-paying job and just could no longer keep up with the payments. I let the credit cards go believing in the myth that after seven years, those credit cards would disappear from my credit report. I was 18 years old and felt that within seven years, I would be 25 and I could just live with my bad credit."

In addition to the demanding responsibility of keeping credit cards in good standing, the Dallas native had a baby, was living in the hood, and was just trying to get by with what she had. “I worked long hours at a low paying job and went to school at night. I would cry on my way to work, on my way to school, and at night in my bed. I remember an era where I just cried all of the time. I just wanted to get ahead financially."

Arnita's woes didn't stop there.

When a job opportunity with an annual salary of $60,000 slipped through her fingers because of her poor credit score, it was a glaring wake-up call. “I went home, pulled my credit report, and my God; my credit was shot. I was embarrassed. I ended up working at a car dealership and while there, I saw the difference between how people were treated with bad credit versus those who had good credit."

“The majority of people aren't taught how to make money, manage money, and definitely weren't taught how to spend it. Applying for too many credit cards, not having a budget, and spending money before you have it may easily cause one to fall into debt."

A strong will and determination are Arnita's hallmarks. It was these characteristics that prompted her to begin taking one step at a time toward the life she knew she deserved. She knew her road to financial recovery wouldn't be short or sweet.

“Where there is a will, there is a way. Budget! Budget! Budget! You have to find out where all of your money is going. You will find it very difficult to become financially independent if you are using your credit cards as a source of income. Trust me on this, NOT all of your money is going towards your needs, some of it is going to towards your wants. Make your credit card(s) work for you.

"Pay off the balance on your credit cards BEFORE the end of the grace period, this way you aren't paying interest. Use a credit card with a cash back reward system, this way you are making money while spending it on something you would have paid cash for anyways. After creating your budget, use the snowball effect to pay off your credit cards. The snowball effect is when you pay off debts or credit cards with the smallest balances. By doing so, it will encourage you to keep paying off other debts."

“It took a major shift in my priorities and I picked up other hobbies. Instead of hanging out with the girls on Friday nights, I would purchase a cheap bottle of wine and cuddle up with a good book. Instead of taking the kids to the movies and pizza, we watched movies on Netflix and made homemade pizzas. I soon realized that I was also saving on gas because I was staying home more.

"I had to learn something that I was never taught in life and that was how to spend, save, and manage money."

Once she had a handle on her spending habits, Arnita began to save. With an estimated 47% of Americans unable to come up with $400 in the event of an emergency, Arnita highly recommends saving as a close second to budgeting on the list of priorities for financial freedom.

“Saving money wasn't easy and took self-motivation and discipline. Because I was living paycheck to paycheck and was pinching any extra money to pay off debts, I found saving any extra money difficult to do. I was very impatient and felt that the little money I was putting back just wasn't enough. I decided to turn off my cable, shop around for cheaper car insurance, and cell phone plans. The extra money I saved each month went straight to a savings account. Starting to see my savings account grow little by little was very therapeutic and exciting for me."

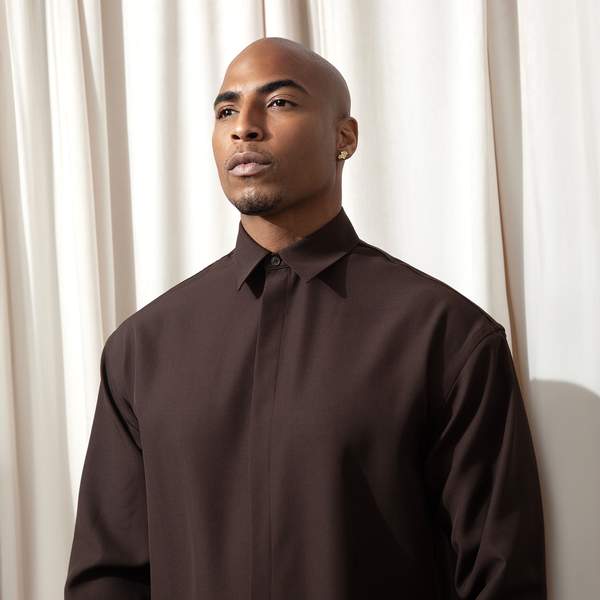

Arnita, a product of her own advice, goes on to describe her process. Set goals…Smash goals…Repeat, seems to be the pattern for this credit industry maven.

Her process wasn't easy in the least. In fact, like the rest of us, Arnita had to take a few “L's" along the way.

“I set short-term goals and long-term goals. I wanted to start setting goals like businesses did. Corporations had quarterly goals and that's what I wanted to start doing. They planned for years to come and budgeted that way. I soon realized I was cutting myself short. I was making business decisions every day. From the clothes I wore, the car I drove, where I purchased gas, where I worked and ate were all business decisions.

"My short-term goals were weekly and monthly and I connected those to my long-term ones. For example, one of my short-term goals was to save enough money to pay off a credit card with a $500 balance that contributed to my long-term goal of paying off all of my credit cards by the end of that year.

"Again, by me being a self-motivator, being able to scratch off shorter goals encouraged me to keep going and reach towards my long-term ones."

Vision and foresight to carry a dream from conception to fruition are what separate the average from the amazing. Rather than pursuing the instant gratification and relief of closing out her credit cards, Arnita took another route.

Arnita details how she was selective during her own process: “When it came to improving my credit report and credit score, I knew that closing out credit cards and waiting for my credit to repair itself was not an option. What was most important was knowing that closing my credit cards was a huge NO-NO. Closing your credit cards can actually lower your credit score because you'd be closing off your credit history, which is 15% of your credit score. I also knew that 30% of your credit score is your credit card usage. Once I began to pay down my credit cards, I knew that my credit score immediately began to increase.

"During this journey, I began to study credit consumer laws and learned that the information on my credit report had to be reported accurately and verifiable. After reviewing my credit report, I saw that a lot of my bad credit came from credit bureaus not reporting correct information about me and by law, I had the right to dispute these errors. With that alone, I was able to increase my credit score over 100 points."

Many women, like Arnita, with vision, passion, and ambition have the drive for success and are ready to “smash the ignition," so to speak, on their goals but feel paralyzed by debt. Some believe bankruptcy to be a viable option for a new start. Arnita calls this a “myth" and reveals the truth in her own terms.

“The myths when it comes to bankruptcy is believing that once you've filed, you are free of all debts and you will have good credit immediately after it is discharged. Sometimes, filing for bankruptcy can make your situation worse. Filing bankruptcy on debts that are past its statue for being sued it not a good idea. Filling debts on collection accounts that cannot be validated within accordance of the law is a waste of money. Lastly, a bankruptcy can remain on your credit report for 7 to 10 years. Moreover, some lenders will not extend credit to those who have filed bankruptcy because they feel they may be a liability and won't commit to paying their debts."

Arnita explains why bankruptcy was never an option for her, “I knew that a bankruptcy would do more harm than good and I knew that no matter how high my credit score, a bankruptcy would hinder me from larger investments, such as purchasing a home and establishing business credit. Besides, I didn't have large assets and felt that filing bankruptcy just wasn't suitable for me."

No longer did the then-single mother have to wait on tax refunds to purchase big ticketed items. Being denied for a job because she couldn't pass a credit check was the straw that broke the camel's back…a wakeup call…an epiphany to confront those financial hurdles with vengeance. “The success of recovering from my own personal credit and financial journey is what led to me to start my business."

Arnita knew there had to be countless of other women out there like her and she needed a way to reach them. Soon after, her credit and financial educational blog, Luxurious CREDIT™, was born.

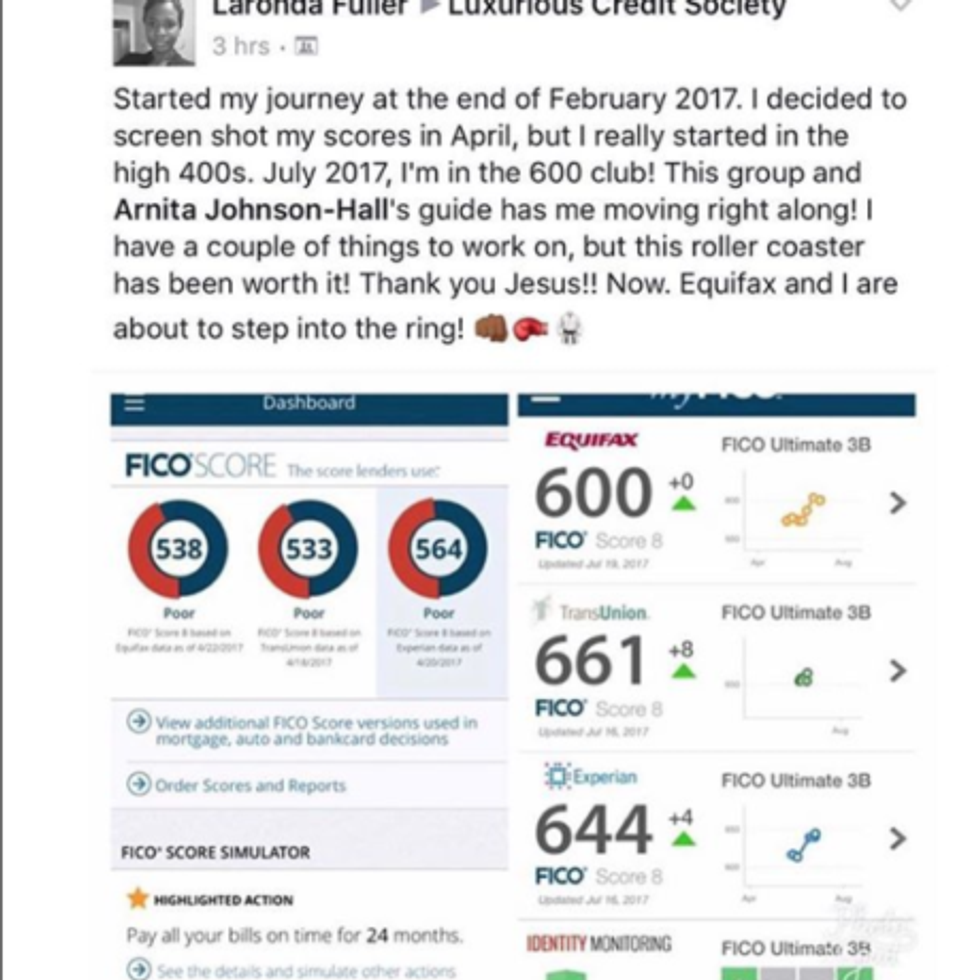

Leveraging social media to create the powerful platform purposed to educate, inform, and assist others to break free from financial bondage, Arnita ushers women into living a “Luxurious Credit Lifestyle" and that lifestyle is having the luxury of being able to get approved for what you want, when you want, on your own terms! She was able to turn her own financial mistakes and lessons in to a platform to teach others on financial freedom, self-investment, and ownership.

Her organizations, Luxurious Credit & AMB Credit, has helped hundreds of thousands of women get out of debt, reach their credit goals of home ownership, purchasing vehicles, building generational wealth, and most of all, feeling luxurious and confident about having happy finances.

Her vision remains revolutionary and successful, not only because it improves the lives of others, but because it teaches them that their alternate reality is just within arm's reach.

“God saved my daughter and I from poverty and therefore, I dedicated myself and business to help others. Good credit really changed my life."

It can change yours too.

To interact with Arnita personally or get advice on how to clean up your credit, simply connect with her on Facebook, Instagram or YouTube. You may also check out the Blog www.LuxuriousCredit.com.