Didn't know April is Financial Literacy Month? Well, now you do. And what better excuse to get your finances in check or figure out how you'll add to your already lit bank accounts? Let's get into some knowledge about credit. It's an issue we all face as we look for ways to reach financial freedom and the best road to where the money resides. Sadly, the stats reflect harsh realities for many of us. Fifty-four percent of Black adults report having no credit or a poor to fair credit score (below 640).

Image via Giphy

Carmen Perez, Varo Bank's personal finance advocate and creator of MakeRealCents.com, a financial fitness platform, shares the good, bad and ugly on credit. Perez, an award-winning professional who's worked for Citi and Morgan Stanley, successfully paid off $57,000 of her own debt in less than three years.

"My finances were a hot mess up until I was able to commit to a plan," she shares. After facing a lawsuit from a private lender, she had to use her last bits of savings to hire a lawyer. She readjusted her budget, completely cut out luxuries like eating out and investing in cable, and reinvested her time into a photography side hustle to bring in more cash. She also kept a close eye on her finances and savings via the cash envelop system, and by the end of 2018, she was debt-free.

It's always good to know where you are before creating a plan to get to where you want to be. So, let's get into some credit 101:

Your Credit Score: The Basics

A credit score, also referred to as your FICO score, is a number that lets lenders know how much of a risk it would be to lend you money. The score ranges from 300 (the lowest) to 850 (the highest). "It is a benchmark that lenders use to gauge how likely a person is to pay back what they owe based on past data. The more you pay things back and on time, the better your credit can be, which can help you borrow money at a lower rate for things you may need," Perez says.

There are three major credit reporting bureaus, TransUnion, Equifax and Experian, and each uses different reporting methods, thus you could have up to three different scores.

"The misconception is that we have one credit score, which is inaccurate. We have multiple, and it depends on what we're applying or aiming for," Perez says. "Your bank, for example, could be showing you a FICO score that might be conducive to opening a credit card, but your score might be different when applying for financing for something else."

Also, various things can impact your credit score, from late bill payments or rental debts to outstanding medical bills and tax liens. On the positive side, a long history of maintaining accounts in good standing, or taking on debt that you're able to manage and pay back consistently over time, are all actions that can contribute to a great credit score.

You can access your credit scores for free via AnnualCreditReport.com, and each report will have specifics on the types of accounts you have on record (such as credit card, mortgage, and student or car loans), the date those accounts were opened, information on your credit limits or loan amounts, as well as details about your payment history. Credit reports also have history on where you've lived and sometimes where you've worked. You'll want to make sure all information is up to date and accurate, especially since some information could be from fraudulent activity, a reporting misake, or an old debt of more than several years that should have dropped off.

For more information on your credit reports, look into resources offered by the credit bureaus, including apps that offer weekly updates on your credit score, credit report information, and credit products available to you. Other easy-to-use and super-helpful websites on understanding your reports are CreditKarma.com and USA.gov.

Image via Giphy

Your Credit Score: The Good

The benefits of having a "good" credit score, which is one that falls generally at a 700 or above, is access to more housing options, more confidence when applying for a loan, and lower interest rates when you get approved. "Good credit allows you to secure better housing and, in some cases, will enable you to bypass having to put a deposit down if you rent," Perez adds. "If you plan on owning, good credit can help you secure a mortgage with better financing terms for you in the long-term. The lower your interest rate, the less you'll pay in interest over time."

"You'll feel less worried about getting denied, which can help you focus more on the things that matter, like negotiating a good interest rate."

But what about if you have no credit at all (i.e. no active accounts being reported to the credit bureaus or your credit history is so limited that there's no score)? Perez recommends getting a secured credit card, one that requires a deposit but offers other great benefits for people who haven't built credit.

"Get one at bank or financial institution that you're looking to have a long-term relationship with---one that offers access to other products. You might put up $500, for example, to open the account, and it will give you access to other products later that you might find beneficial such as home and auto loans."

She also urges women to put some serious thought and research into making decisions about what cards might be best for them. Looking to resources like Nerd Wallet or reading up on your current bank's credit card options (along with the fine print) are your best bet. Be sure to get details on annual fees, card closure policies, and payment protocols.

Image via Giphy

Your Credit: The Bad

In some cases, with a credit score that is below 640, a lender sees you as a higher risk for default or nonpayment of a loan. "If you haven't been good at paying back the money you've already borrowed, lenders will be more hesitant to lend you money," Perez says. "Since they are lending you the money, your loan terms, whether it be a mortgage, car loan, or credit card, will be more favorable for the lender than they will be for you. And since the lender is taking on all the risk, their reward is being able to charge you with a higher interest rate. Interest over time can add up and take away money that could be going toward your future self, like investing for retirement."

Though cash is king, when it comes to buying a home or even renting an apartment, you may need a cosigner to vouch for a loan. "Getting someone else to cosign on anything can be pretty tricky, especially when you already have bad credit," she continues. "You may also be subject to paying high deposits, which can deplete you of cash that could be going toward things like your savings or retirement."

Image via Giphy

Your Credit Score: The Ugly

In Perez's case, she was sued for an outstanding debt, and this is a common practice for some lenders as well as medical service providers and property management companies. Accounts that have reached collections stages and wage garnishments can not only deplete your pockets, but they can indeed negatively impact your credit score. A bad credit score can even affect your employment opportunities. "Sometimes employers will run a credit check on you before giving you the job," she says. "If your credit isn't in a good place, they may not extend the offer."

But you can take bad credit and turn your situation around. Perez recommends looking at all your credit reports and disputing anything that might be out of date or inaccurate. Then address the open accounts with balances that are past due. "Get on the phone with your lender. Explain your situation. See if they have a hardship program, and get the information on what that actually looks like. Get those details up front first, and then go from there." Perez also suggests freezing your credit card and pausing on use versus closing them, something that could negatively impact your credit. If possible, remain in communication with companies or lenders you owe to negotiate a plan for resolving your debt. "If you get the no the first time, continue to call to see if you can get yourself on a payment plan. That's better than [the lender] hitting up your credit because you're not making payments."

There are also credit-card debt relief options offered with the understanding that many are facing pandemic-related hardships, and community resources to get help in building budgets or exploring other debt-relief options.

Perez is also a big advocate of finding a way to earn more income via a side hustle and paying down at a pace that takes into account your current lifestyle and necessities. "Make sure you're prioritizing your bills. If you're in a hole and trying to make it out, it's time to put a budget in place and figure out where your money is going."

Are you a member of our insiders squad? Join us in the xoTribe Members Community today!

Featured image via Shutterstock.

- 5 Crucial Financial Questions You Should Be Asking Your Partner ... ›

- 10 Budgeting Apps That Will Get Your Coins All The Way Together ... ›

- 15 Steps Our Family Took To Improve Our Finances - xoNecole ... ›

- How I Paid Off $7,000 Worth Of Debt In 5 Months - xoNecole ... ›

- How To Build Your Credit Score From 547 To 800+ - xoNecole ... ›

- How To Buy A House With Bad Credit - xoNecole: Women's Interest, Love, Wellness, Beauty ›

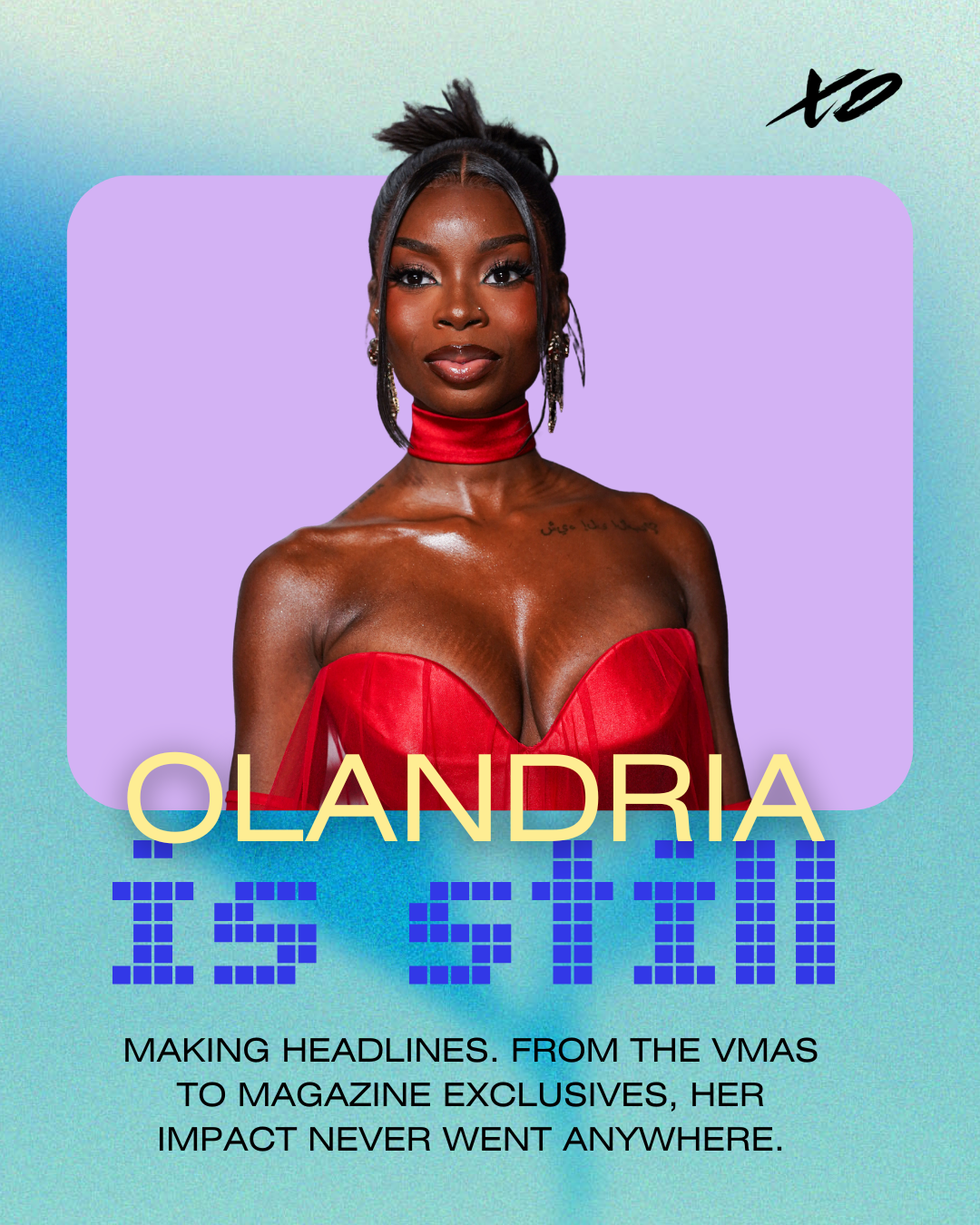

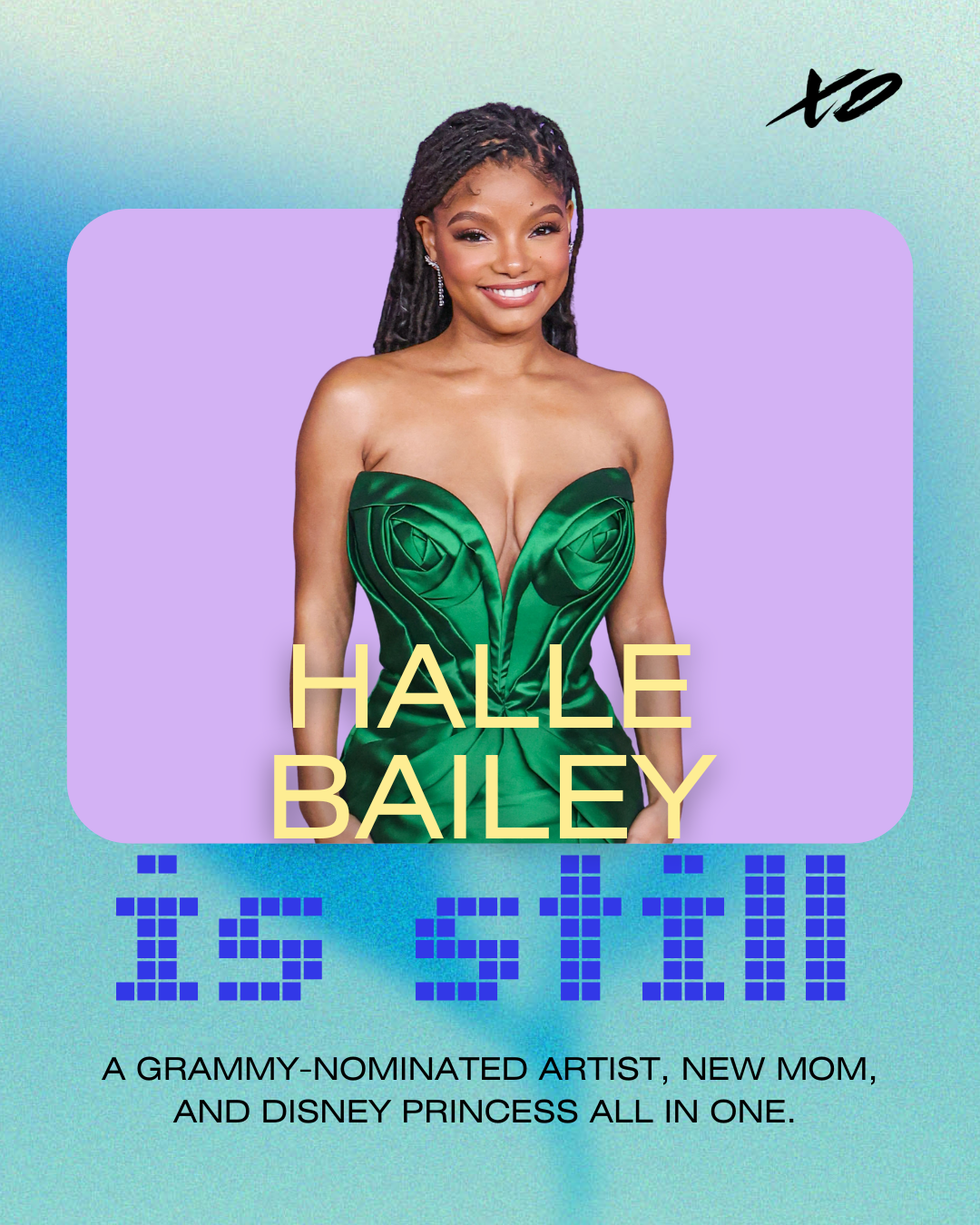

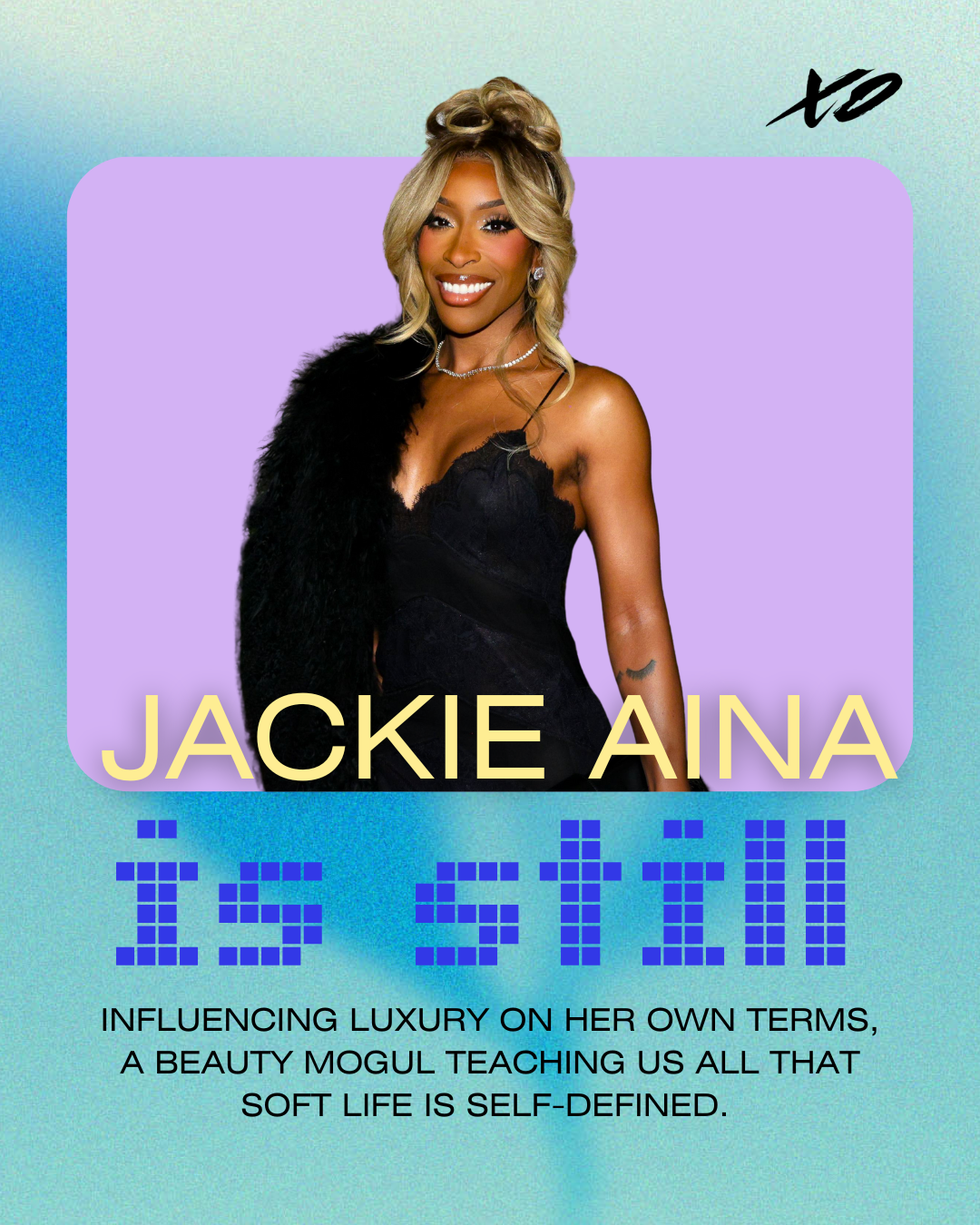

Because We Are Still IT, Girl: It Girl 100 Returns

Last year, when our xoNecole team dropped our inaugural It Girl 100 honoree list, the world felt, ahem, a bit brighter.

It was March 2024, and we still had a Black woman as the Vice President of the United States. DEI rollbacks weren’t being tossed around like confetti. And more than 300,000 Black women were still gainfully employed in the workforce.

Though that was just nineteen months ago, things were different. Perhaps the world then felt more receptive to our light as Black women.

At the time, we launched It Girl 100 to spotlight the huge motion we were making as dope, GenZennial Black women leaving our mark on culture. The girls were on the rise, flourishing, drinking their water, minding their business, leading companies, and learning to do it all softly, in rest. We wanted to celebrate that momentum—because we love that for us.

So, we handpicked one hundred It Girls who embody that palpable It Factor moving through us as young Black women, the kind of motion lighting up the world both IRL and across the internet.

It Girl 100 became xoNecole’s most successful program, with the hashtag organically reaching more than forty million impressions on Instagram in just twenty-four hours. Yes, it caught on like wildfire because we celebrated some of the most brilliant and influential GenZennial women of color setting trends and shaping culture. But more than that, it resonated because the women we celebrated felt seen.

Many were already known in their industries for keeping this generation fly and lit, but rarely received recognition or flowers. It Girl 100 became a safe space to be uplifted, and for us as Black women to bask in what felt like an era of our brilliance, beauty, and boundless influence on full display.

And then, almost overnight, it was as if the rug was pulled from under us as Black women, as the It Girls of the world.

Our much-needed, much-deserved season of ease and soft living quickly metamorphosed into a time of self-preservation and survival. Our motion and economic progression seemed strategically slowed, our light under siege.

The air feels heavier now. The headlines colder. Our Black girl magic is being picked apart and politicized for simply existing.

With that climate shift, as we prepare to launch our second annual It Girl 100 honoree list, our team has had to dig deep on the purpose and intention behind this year’s list. Knowing the spirit of It Girl 100 is about motion, sauce, strides, and progression, how do we celebrate amid uncertainty and collective grief when the juice feels like it is being squeezed out of us?

As we wrestled with that question, we were reminded that this tension isn’t new. Black women have always had to find joy in the midst of struggle, to create light even in the darkest corners. We have carried the weight of scrutiny for generations, expected to be strong, to serve, to smile through the sting. But this moment feels different. It feels deeply personal.

We are living at the intersection of liberation and backlash. We are learning to take off our capes, to say no when we are tired, to embrace softness without apology.

And somehow, the world has found new ways to punish us for it.

In lifestyle, women like Kayla Nicole and Ayesha Curry have been ridiculed for daring to choose themselves. Tracee Ellis Ross was labeled bitter for speaking her truth about love. Meghan Markle, still, cannot breathe without critique.

In politics, Kamala Harris, Letitia James, and Jasmine Crockett are dragged through the mud for standing tall in rooms not built for them.

In sports, Angel Reese, Coco Gauff, and Taylor Townsend have been reminded that even excellence will not shield you from racism or judgment.

In business, visionaries like Diarrha N’Diaye-Mbaye and Melissa Butler are fighting to keep their dreams alive in an economy that too often forgets us first.

Even our icons, Beyoncé, Serena, and SZA, have faced criticism simply for evolving beyond the boxes society tried to keep them in.

From everyday women to cultural phenoms, the pattern is the same. Our light is being tested.

And yet, somehow, through it all, we are still showing up as that girl, and that deserves to be celebrated.

Because while the world debates our worth, we keep raising our value. And that proof is all around us.

This year alone, Naomi Osaka returned from motherhood and mental health challenges to reach the semifinals of the US Open. A’ja Wilson claimed another MVP, reminding us that beauty and dominance can coexist. Brandy and Monica are snatching our edges on tour. Kahlana Barfield Brown sold out her new line in the face of a retailer that had been canceled. And Melissa Butler’s company, The Lip Bar, is projecting a forty percent surge in sales.

We are no longer defining strength by how much pain we can endure. We are defining it by the unbreakable light we continue to radiate.

We are the women walking our daily steps and also continuing to run solid businesses. We are growing in love, taking solo trips, laughing until it hurts, raising babies and ideas, drinking our green juice, and praying our peace back into existence.

We are rediscovering the joy of rest and realizing that softness is not weakness, it is strategy.

And through it all, we continue to lift one another. Emma Grede is creating seats at the table. Valeisha Butterfield has started a fund for jobless Black women. Arian Simone is leading in media with fearless conviction. We are pouring into each other in ways the world rarely sees but always feels.

So yes, we are in the midst of societal warfare. Yes, we are being tested. Yes, we are facing economic strain, political targeting, and public scrutiny. But even war cannot dim a light that is divinely ours.

And we are still shining.

And we are still softening.

And we are still creating.

And we are still It.

That is the quiet magic of Black womanhood, our ability to hold both truth and triumph in the same breath, to say yes, and to life’s contradictions.

It is no coincidence that this year, as SheaMoisture embraces the message “Yes, And,” they stand beside us as partners in celebrating this class of It Girls. Because that phrase, those two simple words, capture the very essence of this moment.

Yes, we are tired. And we are still rising.

Yes, we are questioned. And we are the answer.

Yes, we are bruised. And we are still beautiful.

This year’s It Girl 100 is more than a list. It is a love letter to every Black woman who dares to live out loud in a world that would rather she whisper. This year’s class is living proof of “Yes, And,” women who are finding ways to thrive and to heal, to build and to rest, to lead and to love, all at once.

It is proof that our joy is not naive, our success not accidental. It is the reminder that our light has never needed permission.

So without further ado, we celebrate the It Girl 100 Class of 2025–2026.

We celebrate the millions of us who keep doing it with grace, grit, and glory.

Because despite it all, we still shine.

Because we are still her.

Because we are still IT, girl.

Meet all 100 women shaping culture in the It Girl 100 Class of 2025. View the complete list of honorees here.

Featured image by xoStaff

Someone's Trying To Hook You Up? Ask These 6 Questions First

As we all know, it’s cuffing season. We’re also on the cusp of the holiday season, and that happens to be the time of year when a lot of people get engaged. And that’s why the fall and winter seasons are the times of the year when folks wanna play matchmaker.

And so, sis, if at least one person in your life is currently trying to set you up with someone they know right now — charge it to it being “tis the season” more than anything else. Because let’s be real — folks tend to be more lovey-dovey than ever right about now, and that is usually what inspires them to try to get as many people boo/bae’d up as possible. Chile…CHILE.

It’s not like it has to be a bad thing. In fact, studies say that somewhere around 15 percent of engaged couples actually met through a friend. All I’m saying is, before you entertain someone’s “I’ve got someone I want you to meet” invitation, it would benefit you to interview them first — for the sake of all parties involved.

The questions that I recommend asking? The following six are what I think can get everyone on the same page, so that there is more pleasure than regret from the hook-up attempt.

1. Why Are They So Invested?

Giphy

GiphyTwo things that I recently watched over again are the series Survivor’s Remorse (the writing is so damn good) and a movie called Trapped in Temptation (both are currently on Tubi). Something that both of them made me think about is the fact that motive reveals a lot when it comes to why people say and do the things that they do.

When it comes to the movie, specifically, without giving the film away — let me just say that, if you are in a relationship, be really careful about listening to individuals who try to talk you out of maintaining it. More times than not, the motive is shady as hell. And honestly, sometimes people who are close to obsessed with you being in one deserve a bit of side-eye too.

Now, if it’s someone who loves all things love, they are in love and they want you to experience something similar — that’s sweet. Just make sure that they are approaching the set up from a healthy space. What I mean by that is they don’t see singleness as some sort of relational handicap or they aren’t trying to override what you want for your life as if they somehow know better (there are so many ways to be a control freak, y’all).

Hmph. Now that I think about it — make sure that the set-up crew isn’t trying to use you to “save” some male friend or relative of theirs. I say that because I once knew a mother whose son had — count ‘em — 10 kids and she was FOREVER trying to get me to date him. Girl, that wasn’t for me. She was looking for a Holy Ghost Jr. for that child of hers. I’ll pass. HARD PASS.

Bottom line with this one — if someone wants to set you up with someone else, the first thing to ask is why? Make sure to really listen to what their answer is. Then pay attention to if your mind, body and spirit are at peace with their answer(s).

2. Do They Know What You Want?

Giphy

GiphyI don’t know about y’all, but the people (and let’s be honest, by far, it’s usually women) who have tried to set me up with someone? They didn’t even know what my preferences or type was. Hell, they didn’t even know my thoughts or timeline as it relates to being in a serious relationship were either. And what that boils down to is they were trying to hook me up based on their agenda, not mine — and that usually meant that the guys who they came up with? Yeah…I was good on them. LOL.

Yeah, if someone wants to hook you up, you definitely should ask them if they know what you are looking for in a guy when it comes to his looks, personality, passions, spirituality, relational desires and goals, location, etc. Because, indeed, what is the point in going out with someone who is fine as hell and yet, you want kids and he doesn’t (or vice versa) or who has a great personality yet he isn’t even in the same ballpark of your spiritual beliefs?

If your friend really wants to help you out, valuing your time should come with that — and that means bringing someone into your life who complements your lifestyle. No wiggle room here.

3. Are They Aware of Your Deal-Breakers?

Giphy

GiphyLast year, I wrote an article for the platform entitled, “Should Bad Sex Actually Be A Relationship Deal-Breaker?” The thing that I think needs to go on record about deal-breakers is they aren’t exactly standards that you have. No, a deal-breaker is something that can’t be worked out even after trying to negotiate or compromise. When it comes to relationships, a deal-breaker might be how long two people should date before becoming exclusive or getting engaged. Another deal-breaker might be if being religious is more important than being spiritual and how that manifests itself (church or no church, etc.). And yes, another deal-breaker may be what each other’s sexual needs and expectations are.

When someone is setting you up, it is imperative that they know about your standards. For instance, for me, I am not interested in dating a divorced person, pretty much ever (I Corinthians 7:10-11). I’ve had friends who have tried to hook me up with that demographic before and it has always been a moot effort. The fact that some of them have gotten frustrated with my convictions has absolutely nothing to do with me. Some have tried to get me to compromise my deal-breakers too — like a long-distance relationship. Is it a firm “naw”? No. However, it’s not really something that I am interested in, so why not just…recommend someone local?

Yeah, if someone thinks that they know you well enough to hook you up, they absolutely should be well-versed in what your deal-breakers are before they do. And if they’ve never asked, all they are doing is assuming — and we know what that typically means. LOL.

4. What Is Their Track Record?

Giphy

GiphyIt’s kind of wild that we now live in a time when more couples meet online than they do through “old-fashioned ways” like via their friends (although some reports say that Gen Z is getting back to that) — and yet, here we are. Still, if you are willing to let someone play pseudo matchmaker in your life, you are well within your rights to inquire about their track record in that department. Have they hooked others up, successfully, before? Has any of their “Cupid work” caused both people to get exactly what they wanted out of the situation? If/when things went awry, why was that?

I know someone who is constantly trying to hook people up. Thing is, maybe 10-15 percent (no joke) of their efforts have proven to be positive and fruitful — and we’re talking about close to close to two decades of them doing it. Listen, time is too precious to be out here doing stuff ONLY to please other people. That said, if someone wants you to devote some time to one of their grand ideas, you are well within your rights to ask about their past and current success score when it comes to it.

5. Can They Keep Their Own Feelings Out of It?

Giphy

GiphyWanna know if someone who is offering to do something for you is actually doing it more for themselves? If they try to make it be about them when things don’t go the way they would like, that is a dead ringer. An example? They post a message about you on social media and then question you about why you didn’t do the same thing in return. Another example? They do something for you and then throw it in your face during an argument. Still another example? They set you up with someone, it doesn’t work out, and suddenly you’ve put them in a weird spot. No dear — you put your own self in that position by trying to hook two people up in the first place.

I promise you, it will spare everyone unnecessary energy spent (or even drama experienced) if, before you agree to be hooked up, you get the matchmaker on record stating that they will keep their emotions out of it as much as possible. MEANING — they will do the introductions and then let the chips fall where they may. If they can’t do this, my two cents (save it or spend it) would be to decline the offer. Because all you need is someone texting you about why you haven’t called their cousin back or having an attitude with you when you break up with some guy at their church who they thought was the perfect catch (P.S. These aren’t hypothetical examples — LOL).

6. Will They Respect Your Boundaries? Start to Finish?

Giphy

GiphyYeah, this final one is a biggie. Just because someone sets you up with another person, that doesn’t automatically or necessarily mean that they should have the right to the details of the dynamic. I don’t care if it’s the first date or the 10th date. I don’t care if you decide to just be sex buddies or to have a full-blown relationship. I don’t care if you stay together or break-up — it’s your relationship which makes it your business. Whatever you share is privileged data.

Yeah, I would say that probably the most challenging thing about being hooked up by someone you know is they have a tendency to think that they are a part of the relationship too — and that is a lie. If things go well beyond a couple of dates, you and the guy should discuss what you will both share with the person who introduced you and then agree to stick to that boundary, no matter what. It’s a great way to protect the dynamic, to keep “outside voices” from influencing the growth and to navigate how you want to move, moving forward.

Someone who hooked you up for the right reasons and knows how to honor limits? They will understand. Will they ask questions? Absolutely. Will they pry? Nah.

___

Should you sit and let someone hook you up? I mean, you never know how your blessing will come. Just make sure that they are prepared for you to do some digging into their mindset before they start sweetly meddling into your love life.

It’s only fair. Hell, and right. LOL.

Let’s make things inbox official! Sign up for the xoNecole newsletter for love, wellness, career, and exclusive content delivered straight to your inbox.

Featured image by PeopleImages/Shutterstock