Becoming A Single Mom To A Newborn At Age 49 Was The Best Choice I’ve Ever Made

I am a 51-year-old single mom who lives at home with my parents –and I’m the happiest I’ve ever been.

But it wasn’t always this way.

I spent most of my adult life working as a broadcast journalist. After graduating from Baylor, I moved a lot and often far from home– anchoring in Waco, Las Vegas, and St. Louis, then eventually in Atlanta.

I had a dream career: I worked at CNN’s Headline News for seven years.

I was an Emmy award-winning journalist, and my work often focused on women and children. I interviewed a number of women who had overcome major challenges, including Mary J. Blige, Janet Jackson, Misty Copeland and one of Afghanistan’s most prominent politicians Fauzia Koofi. In 2016, I relocated my life to Doha, Qatar to be a presenter on Al Jazeera English.

From the outside looking in, my life probably looked amazing. Doha was incredible. I did what looked like, and often felt like, glamorous work and international travel–frequent trips to Dubai, Seychelles, Bali, Addis Ababa and Venice. If you judge success in life by distance traveled and miles accrued, I suppose you could say I was winning.

The reality, as always, was more complex. For all my travels and adventures, I was often alone. Sometimes this was by choice, but other times I found myself longing for a partner with whom I could share those experiences.

But the farther you go, the harder it can be to find a companion who can keep up. To talk about my failed relationships would take too long, and they were never the true focus of my life or my story. Still, that solitude occasionally crept into loneliness, and I could feel time starting to slip away.

When I was in my 20s and early 30s, I didn't think much about starting a family. I was focused on my career, and I assumed my domestic bliss would just work itself out. In my younger years, I already had a dream job working in Atlanta, a mecca for successful Black professionals. Surely I would meet a great guy, have a picture-perfect destination wedding, and start a family. That didn't happen.

While I was waiting to get married to start a family, I could sense my biological clock ticking.

I remember hoping that feeling would go away and also being envious of my friends who knew they didn’t want children. But that wasn’t me; the desire to be a mom never faded. I realized I kept putting off motherhood by waiting on some imaginary person.

In my 30s, a friend of mine worked for one of the most prominent fertility clinics in the country; she suggested I consider freezing my eggs. I didn't know much about the process other than it was expensive!

I had a well-paying job but spending up to $50,000 for something I didn't know I needed or wasn’t guaranteed to work, was a major financial commitment. So I put it off for a few more years while still looking for love.

At 43, scared my fertility window would close while I was waiting on a partner, I realized I needed to stop giving other people power over how and when I created my family. It was time to freeze my eggs.

Most studies suggest that women who freeze their eggs before age 35 have a better chance of a successful pregnancy. Because I had put it off for so long, the doctor was only able to retrieve five eggs, but at least I had those for when the right man came along. Over the next three years, the right man did not come along. I also considered having a baby with a male friend but then nixed that idea, because … boundaries. Time was ticking.

At 46, I finally grew tired of waiting and decided it was time to use the eggs. That meant going through a sperm bank. My friends helped me pick the right donor.

It was a surreal experience, but I was very realistic that the chances of in-vitro fertilization (IVF) working were slim, so when it didn’t work, I was disappointed, but not devastated. I considered trying again but decided it wasn’t worth the cost or the risk. It was time to pivot on my path to motherhood.

The next step was adoption, so I started researching options. At the time I was living in Doha, which presented a few hurdles. First, I had to hire and foot the bill for a social worker.

If I was living in the United States, I could have more easily found a social worker to conduct the home study—a comprehensive screening of prospective adoptive parents that has to occur prior to approval for adoption. I found one who was based in Germany, but I had to fly him to Doha to complete the inspection.

Another challenge was finding a U.S. agency that would work with me despite the fact that I lived abroad. Miraculously, I was able to get on the waiting list with an agency in Texas—and was approved to become an adoptive parent in late 2018.

Richelle Carey and Avery

Courtesy of Richelle Carey

After a couple picked a different family over me, probably because I lived too far away, I started previewing the disappointment in my head and thinking about how striking out at adoption would crush me much more than my struggles with IVF did. Maybe because it felt more final, or because I was relying on the judgments of others.

Still, I remained hopeful. I kept telling myself that the right baby would find me no matter where I was, but I could improve my odds if I was more focused on my journey. So, I left my dream job.

Leaving a career is always tough, especially when you don’t know how things will work out, where you’ll be, or when you’ll work again. But I knew it was time. I had little left to prove to myself professionally. So I quit my job as a news anchor more than two years ago and moved home to Houston.

I fully acknowledge that my choices come from a place of privilege. I was successful enough in my career to save money, quit without having another job lined up, and move to my parents' fully furnished studio apartment above the garage.

I was still a bit uneasy about it, and at times even scared. I was staring down the barrel at 50, and if you told me that at that age, I would be single and living in my parents’ guest house, I would’ve thought that I had screwed up my life. I certainly never aspired to it.

I think we intellectually know life can happen for us in a variety of ways but find it hard to accept the non-traditional path might be the one we end up taking. Even if we do and receive everything we want, it feels wrong until it feels right.

Matching with my son was a years-long process. Then finally in March 2021 in the depths of pandemic isolation and global despair, I received a call from the adoption agency, saying a birth mother who had a six-week-old baby was interested in meeting me. The very next day, I drove three hours to Dallas to meet them.

As soon as I saw that beautiful baby boy, I knew at once he was the baby I’d been waiting and trying for all this time. The next morning, I told the agency I wanted to adopt him. Four days later, Avery was home with me.

My life now has transformed from globetrotting to potty-training and I wouldn’t trade it for the world. Everything you hear about parenting being exhausting is true. What is also true is seeing your child happy makes all that exhaustion worth it. The absolute best sound in the world is a child laughing, which my little comedian Avery does often.

In my work, I often focused my coverage on women and children. In many ways, my motherhood journey is a continuation of that work.

I hope people learn from my story that your path to motherhood doesn’t need to look a certain way or happen in a specific order. I hope my journey encourages women to embrace a variety of paths to motherhood.

You may have your heart set on having a child that is biologically yours, but if that doesn’t happen for you, be open to other options such as egg donors or adoption. Some companies offer insurance options for egg freezing and IVF or can also help with adoption costs. You can even consider becoming a foster parent, which can lead to adoption later on.

Being a single mom over 50 wasn’t how I thought I would end up. I dreamed of something way more straightforward and dare I say it, conventional. I think I knew the road ahead wasn’t going to be comfortable, but it has been more rewarding than I could’ve ever imagined.

And, that road is still just beginning.

Let’s make things inbox official! Sign up for the xoNecole newsletter for daily love, wellness, career, and exclusive content delivered straight to your inbox.

Feature image courtesy of Richelle Carey.Your December 2025 Monthly Horoscopes Are All About Surrender & Alignment

December is about letting go. We end the year with the need for more peace, reflection, and rejuvenation, and that is exactly what December is providing for us. The Sun is in Sagittarius, and anything is possible. This is the month to believe in that and to know that the universe is supporting you. With a Supermoon in Gemini as we begin the month as well, we have an opportunity to gain the closure we have been looking for this year and to wrap up old projects, ideas, and communication breakthroughs.

This is the month to make your peace the priority and let go of trying to control the way the tides are turning. Trust in your new beginning, and give yourself time to prepare for it this month.

A big part of the clarity that is coming through this month is due to Neptune going direct in Pisces on December 10, after being retrograde here since July. With Neptune now direct, we are able to see our inspiration and creativity a little more clearly, providing the perfect energy for dreams and manifestation to be built upon. The smoke is clearing, and it’s up to you to decide what you want to do with this newfound clarity that this transit is bringing. Mercury also moves back into Sagittarius on December 11, which is great for communication and clarity, and the adventures you were trying to see through at the beginning of November come around for you again with greater purpose and support.

On December 15, Mars enters Capricorn until the end of January 2026, and this is the extra push we need to make important changes and to be on the path towards greater abundance, stability, and prosperity. Mars in Capricorn takes care of business, and we have extra energy at our disposal during this time to do so. This transit is an ideal time to focus on your career or financial goals for next year and to start putting some of these plans into motion now. A few days later, we have the New Moon of the month, which will be in Sagittarius on December 19, and this is the perfect New Moon to manifest.

The energy is high, magic is in the air, and it’s all about moving forward with the new beginnings that are inspiring you and bringing you joy to think about right now.

Capricorn Season officially begins on December 21, and this earth sign energy is how we heal, gain closure, and build new foundations in our world. With Venus also moving into a Capricorn a few days later, there is something about peace, prosperity, and security that we are gaining in life and in love as we close out the year, and this is what we need right now. This month is about reflecting on what was, letting go of old hurt, and renewing. December is an ending and a new beginning in one, and there is magic in this space to be created.

Read for your sun and rising sign below to see what December 2025 has in store for you.

AriesKyra Jay for xoNecole

AriesKyra Jay for xoNecoleARIES

December is a full-circle moment for you, Aries. You are seeing the gifts in your world and have a lot of gratitude for the way things have come about for you as of late. There are culminations in your world that are providing you with more abundance, stability, and community, and you are exactly where you are meant to be this month. With the Sun in a fellow fire sign and in your 9th house of travel for most of the month, December is a good time to get out of your comfort zone, explore the world around you, and get your body moving.

Mars, your ruling planet, also makes a change and moves into Capricorn on December 15, which will fuel your inspiration and power in your career space. You are making a lot of professional progress as we close out the year; however, make sure to be more mindful of your competitive drive right now. The New Moon on December 19 is the perfect opportunity for you to create some new plans and goals when it comes to traveling, education, and where you want to gain some new inspiration in your world. Overall, this is a month of things coming together for you serendipitously.

TaurusKyra Jay for xoNecole

TaurusKyra Jay for xoNecoleTAURUS

December is about trusting your intuition, Taurus. You have a lot on your mind this month, and it’s best to delegate, communicate, and allow yourself some relief by opening up to someone and not feeling like you have to hold everything in. As we begin the month, we have a Supermoon in Gemini happening in your house of income, and the plans and projects you have been building here come to fruition for you now. This is the time to gain clarity on your financial world and to take a look at what spending habits you want to let go of here as well.

With Venus in your 8th house of shared resources for most of the month, you are doing a cleanse on your commitments, partnerships, and business ventures. You are taking a look at what you want to dedicate yourself to in the future, and what commitments you may need to let go of now in order to be in the space you truly want to be, both financially and within some of your relationship dynamics. Before we end the month, we have a New Moon in this same area of your chart, and it’s time to look at the opportunities that are presenting themselves and to trust your internal guidance system to lead you forward.

GeminiKyra Jay for xoNecole

GeminiKyra Jay for xoNecoleGEMINI

You are moving forward fearlessly this month, Gemini. December is your month of love, passion, and dignity, and you are owning the light that you shine. We begin the month with the last Supermoon of the year, happening in your sign, and you are stepping up to the plate. You are showing up, owning how much you have grown this year, and allowing yourself to heal while also acknowledging that you have done your best and you deserve to have fun in the midst of the changes you are creating.

Mercury, your ruling planet, is officially out of retrograde, and you can use this energy to the fullest potential now. With Mercury in your 7th house of love, it’s time to speak from the heart and to talk about the things that matter and that are inspiring you right now to your loved ones. You never know what kind of epiphanies you may have when you open up the conversation to others. Before the month ends, you have a New Moon in this same love area of your chart, and this New Moon is all about manifesting romance, commitment, and abundance in your world.

CancerKyra Jay for xoNecole

CancerKyra Jay for xoNecoleCANCER

December is an opening for more love, more joy, and more freedom in your life, Cancer. You have come to a place where you hold so much gratitude in your heart for where you are today and where your heart is shining, and things come together for you with more ease right now. With the Sun in your 6th house of health, work, and daily routines for most of the month, you are getting your ducks in a row while also putting more energy and effort into taking care of yourself, your priorities, and your well-being. This month surprises you in many ways, and it’s because you are showing up.

Mars and Venus both move into your house of love, relationships, marriage, and abundance this month, and you are making strides in your love life. You have both of these opposing forces on your side and are being recognized for the love you are while also receiving the love you want. This month, overall, is about focusing more on the positives in your world and letting your heart have its joy. Before December comes to an end, there is a New Moon in Sagittarius, and this is the perfect opportunity to create the plans you want to see through next year, especially when it comes to your work life, colleagues, business ventures, and health.

LeoKyra Jay for xoNecole

LeoKyra Jay for xoNecoleLEO

The scales of karma are balancing, and they are balancing in your favor this month, Leo. December is your month of truth, and of seeing it clearly in your world. The Sun is in your house of romance, pleasure, and happiness for most of the month, and it’s time to relax, be in the present moment, and allow what is meant to be, to be. With a Supermoon in your 11th house of manifestation as December begins, this is a powerful month for seeing your dreams come to fruition, and for feeling like the intentions you have set this year are finally here for you now.

Mars also moves into your 6th house mid-month, and this is the perfect energy to have to move into the new year. You have extra energy at your disposal right now and are feeling fearless with what is possible for you and your daily routine. Before the month ends, we also have a New Moon in a fellow fire sign, Sagittarius, and this is a breakthrough moment for you and your heart. December, overall, wants to show you how loved and supported you are and will be doing so in magical, unexpected, and concrete ways.

VirgoKyra Jay for xoNecole

VirgoKyra Jay for xoNecoleVIRGO

December is a month of victory, Virgo. You are showing up and experiencing some new successes in your world that move you forward on your path in life. With a Supermoon in your 10th house of career as we begin the month, the effort and intentions you have made this year come into full bloom, and you are being recognized for who you are and the good work you have done. This month is all about showing up and allowing yourself to be seen and loved, knowing that you deserve the support and opportunities you are receiving.

Mars moves into Capricorn on December 15, which brings the passion and excitement into your love life, hobbies, and little pleasures in life that light you up. You want to have fun this month and are going to be walking into the new year with this fearless, happy, and spontaneous energy within you. Before the month ends, Venus also enters Capricorn, and in this same area of your chart, you have a lot to look forward to and believe in right now. Overall, December wants you to be happy and will be doing everything possible to make that happen for you. This is your month to shine, Virgo.

LibraKyra Jay for xoNecole

LibraKyra Jay for xoNecoleLIBRA

December is a month of opportunity for you, Libra. New doors open, and you are financially making breakthroughs this month because of it. December begins with a Supermoon in your 9th house, and you are getting a clearer view of where you have been making strides in your life and how it has all brought you here to this present moment of freedom. This month is showing you what happens when you are fearless with your purpose and when you believe in yourself and what you are worthy of.

Moving further into December, Mars moves into your 4th house of home and family mid-month, and you are closing out the year in your safe spaces. You are spending more time with your loved ones and taking the time to quiet your mind and listen to what your heart has been telling you. Before the month ends, we have a New Moon in Sagittarius, happening in an area of your life that deals with communication. This is a great time for getting the answers you have been looking for and for feeling more clear-headed and confident about the decisions you are making as you move into the new year.

ScorpioKyra Jay for xoNecole

ScorpioKyra Jay for xoNecoleSCORPIO

Patience is a virtue this month, Scorpio. December is all about remaining patient and vigilant with what you are creating in your world, and knowing that the universe has your back. It’s time to be reminded of the power of hope, and this month is an opening to greater clarity in your life. There is a lot of energy in your financial zones right now, and this is providing you with new opportunities and new insight; however, the speed at which things come about for you may feel daunting. Keep your head up and eyes focused on what you want and know that you are more than worthy of receiving it.

With Mercury in your 2nd house of income this month, December is a good time to plant new seeds and to think about where you want to be financially a month from now or even a year. This month is asking you to think bigger and to think more long-term so that you can set the appropriate plans into motion now. We also have a New Moon in your house of income before the month ends, and this is when you will see more of your dreams come to fruition in this area of your life, and have more opportunities to build. Overall, December will be teaching you a lot, Scorpio.

SagittariusKyra Jay for xoNecole

SagittariusKyra Jay for xoNecoleSAGITTARIUS

Sagittarius Season is here, and there is a lot in store for you this month, Sag. December is all about what you are dedicating yourself to. It’s about setting your intentions and putting the work in to back up your dreams, and about getting things in order so that when the new beginnings come, you are ready for them. The Sun and Venus are in your sign for most of this month, and there are a lot of eyes on you right now. You have the potential to create a new beginning for yourself, and it’s time to invest in yourself, your love life, and your dreams.

Mercury moves into Sagittarius on December 11, and this is giving you another opportunity to see through some of the plans that you had initiated in November. Mercury was retrograde in your sign last month, and there may have been some disruptions to your vision and plans for the future, and now this energy is turning around for you. Before the month ends, we also have a New Moon in Sagittarius, and you are walking through new doors fearlessly. You are catching others by surprise by your growth this month, and you are thinking a lot about your purpose, future, and plans for the new year.

CapricornKyra Jay for xoNecole

CapricornKyra Jay for xoNecoleCAPRICORN

December is all about the vision, Capricorn. You are moving through a lot of changes and transformations this month, yet they are giving you a chance at a new beginning in the process. You are focused more on the future and what goals you want to manifest for yourself right now, and are ready to let go of what hasn’t been working for you. With the Sun in your 12th house of closure for most of December, this is your time for healing, but remember, healing doesn’t have to be isolating or boring; you can thrive while you renew, and you are this month.

Mid-month, the excitement picks up for you, and you are feeling more energized than you have in a while. Mars moves into Capricorn until the end of January 2026, and you are being proactive with your goals, intentions, and passions. You are a force to be reckoned with this month, and you are making things happen for yourself with confidence. Capricorn Season officially begins on December 21 this year, and this is definitely speeding up your healing process. You are breaking free from what was, and with Venus also moving into Capricorn before the month ends, you are leaving this year in high spirits and with love opening a new door for you.

AquariusKyra Jay for xoNecole

AquariusKyra Jay for xoNecoleAQUARIUS

December is all about community, creativity, and manifestation, Aquarius. This is the month to work together with others to help bring your dreams to life. You are in a space of inspiration, empowerment, and beauty, and are creating more of this energy around you and in your world. Look out for what support comes your way this month and know that you don’t have to do everything alone to succeed. With the Sun in your 11th house of manifestation and friendship, your intentions are coming to fruition, and it’s time to celebrate with the people you love and to own how far you have come this year.

On December 19, we have a New Moon in Sagittarius, lighting up your life in all of the best ways possible. This is your New Moon of freedom, victory, and magic, and you are seeing new beginnings appear that you were once just hoping for. Before the month comes to an end, Venus moves into your 12th house of closure, and after an active and successful month, you are ready to relax, heal, and give your heart some of the attention it has been asking for. You are moving into the new year with the need to release and renew what hasn’t been working in your relationships, and you are finally ready to.

PiscesKyra Jay for xoNecole

PiscesKyra Jay for xoNecolePISCES

December is a big month for you, Pisces. You are making some huge accomplishments this month, and are feeling like everything you have been through this year has been worth it for these moments that are coming to fruition for you now. The Sun is in your 10th house of career and reputation for most of the month, and this is where a lot of your focus is right now. You are claiming your successes and putting yourself out there in ways that not only serve you, but that inspire others as well.

Neptune officially goes direct on December 10, after being retrograde in your sign since July, and you are finally seeing things a little more clearly. You are feeling renewed inspiration and passion in your life, and your intuition is your strongest asset right now. Before December comes to an end, we also have a New Moon in your 10th house of career, and what happens now not only changes things for you in the present, but it also opens new doors and what is possible for you in the new year as well. Overall, you are on top of your game this month and are owning the joy and empowerment you feel.

Featured image by Kyra Jay for xoNecole

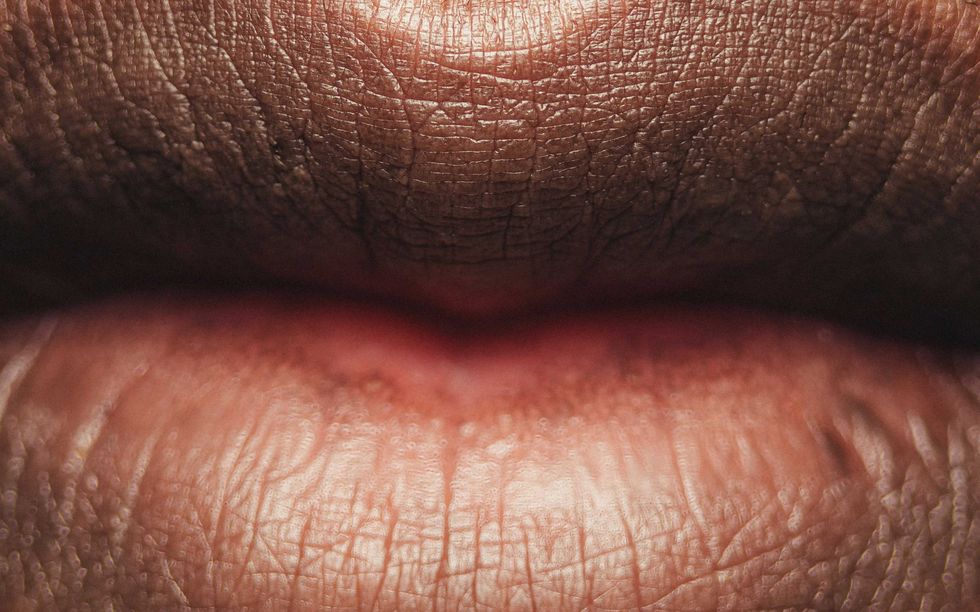

Cold winds. Wool clothes. Flannel sheets. These are just some of the things that skin has to go through whenever the temperature drops below freezing — and boy, can that wreak real havoc on it if you’re trying to have super soft and smooth skin that looks amazing in your holiday party outfits and feels unbelievable as you’re cuddling up to your bae.

And you know what? The key to combating dry, cracked, rough, dull, and irritated skin during the fall and winter seasons is to be proactive about preventing it from happening in the first place. Luckily, I’ve got eight quick tips that can keep your skin dewy and radiant — no matter what these next few months, weather-wise, have in mind.

1. Turn the Temperatures Down

Unsplash

There is nothing like coming in from the bitter cold and feeling the heat from your HVAC unit. Problem is, since the air draws moisture out while constantly circulating warm-to-hot air in the process, that can totally dehydrate your skin — and dry skin tends to feel rough, flaky and tight.

One way to combat this is to keep your thermostat(s) set to somewhere around 68 degrees; not only is that good for maintaining some level of moisture in the air, your electricity bills will remain bearable that way as well.

2. Eat/Drink Less of What Dehydrates You

Unsplash

Did you know that there are certain foods that, one way or another, will play a role in dehydrating you? Sugary foods will cause you to release more fluids through your system. Salty foods can absorb hydration in your body. Alcohol and caffeine are considered to be diuretics which means that they take more fluids from you than they actually provide.

And something else that can take more water from you than it should? Believe it or not, protein. Although it does come with its benefits, because it can put a bit of strain on your kidneys, you may need to drink more water, just so that you can get rid of toxins easier.

Meanwhile, foods that will hydrate you are fresh fruits and veggies. Ones that are in this season include apples, grapes, collard greens, celery, pears, cabbage and winter squash.

3. Go with Unscented Body Washes

Unsplash

Some of you may not like this one; however, if you read it all the way through, I have an alternative that may just put a smile on your face. Okay, so your scented body washes — yeah, if you want healthy and supple skin, you should scale back on those bad boys. The reason why is because many of them contain sulfates and artificial fragrances that are harsh on your skin and can end up drying it out.

The alternative? Use unscented ones and then add an essential oil scent to it. For the record, ones that actually help to soften your skin include lavender, sandalwood, chamomile, frankincense and rose.

4. Exfoliate Less. Hydrate More.

Unsplash

Since your skin sheds somewhere around 30,000 skin cells a minute (wild, right?), it is absolutely essential that you exfoliate your skin year-round. After all, exfoliating is what not only removes dead skin cells and unclog pores, it also helps significantly improve your skin’s tone and texture by increasing the collagen production that is in it. However, since it also has a way of drying out your skin, it’s important that you gently exfoliate during this time of year; this means less scrubs and dry brushing less often.

Instead, exfoliate with certain skin acids (which I will get to in a sec) and focus on doing what will hydrate your skin more including drinking plenty of water and applying serums to your skin. Serums are a light product that is full of ingredients that are especially designed to help moisturize and protect your skin.

5. Apply Some Acids (Yep, You Read That Right)

Unsplash

On the surface (no pun intended), it might seem odd that acid can help to soften your skin yet that is absolutely the truth. Examples? While hyaluronic acid (check out “Why Your Skin, Hair, And Nails Need Hyaluronic Acid Like...Yesterday”) is a humectant that helps to moisturize your skin and reduce any “roughness” that it may feel, malic acid is an alpha hydroxy acid that improves your skin’s texture.

And while lactic acid is a fruit acid that provides moisture by increasing collagen production, mandelic acid (one of my current faves) will help to even and smooth your skin right on out.

6. Try Some (Holiday-Scented) Oils and Creams

Unsplash

If you want to provide a barrier for your skin from the cold weather and bitter winds, you should consider applying oils to your skin; ones that are packed with fatty acids like avocado, sunflower and grapeseed. Creams can be super nourishing for your skin too; that’s because they have a way of locking in moisture for longer periods of time.

And if you really want to take things up a notch, add some holiday-scented essential oils to your oils and creams — ones like vanilla, clove, cranberry, peppermint and plum. You can even mix one or two together to create a signature scent that is all your own.

7. Put Rosehip Oil on Your Lips

Unsplash

What would be the point in having silky smooth skin if your lips are dry and chapped? C’mon now. That’s why, especially before you turn in every night, it’s a good idea to apply a coat of rosehip oil to your lips. Not only are the properties in the oil extremely moisturizing and hydrating, it’s the kind of oil that can help to cultivate new cells to your lips and even create collagen so that they appear firm and youthful.

8. Turn on Your Humidifier

Unsplash

The reason why I wrote “10 Really Good Reasons To Get Yourself A Humidifier This Fall” a few years back is because folks tend to really underestimate how beneficial a humidifier can be. When it comes to your skin, specifically, you should consider investing in one because the added air moisture that they provide helps to hydrate your skin as well as balance sebum levels, provide a protective barrier from indoor air pollution and soothe irritated skin as well.

And since sleep is a way to restore your skin, having a humidifier going in your bedroom will take “beauty sleep” and super smooth skin to a whole ‘nother level. Enjoy!

Let’s make things inbox official! Sign up for the xoNecole newsletter for love, wellness, career, and exclusive content delivered straight to your inbox.

Featured image by Prostock-studio/Shutterstock