These Women Are Debunking Myths About Debt And Educating Others On Financial Literacy

Growing up, my parents always told me to save my money. Did I always listen? Of course not, but it’s one of the pieces of financial advice that I remember. I was also told not to depend on credit cards. I often saw my parents use their debit cards to pay for everything, and it wasn’t until I got older that I learned how to use credit cards to my advantage.

While talking to Natalia Brown and Dasha Kennedy, I learned I wasn’t the only one who grew up with similar teachings. Natalia serves as the Chief Compliance and Consumer Affairs Officer for National Debt Relief (NDR), and Dasha is a Financial Wellness Board Member for NDR and also runs the online platform The Broke Black Girl. Together, they are educating Black women and others on debt, the good and the bad.

They each have had their fair share of unlearning to do after going through rough patches that eventually started them on their financial wellness journeys. During our interview, Dasha and Natalia debunked myths about debt and broke down the many things that helped them on their way. One of those myths is that debt is bad. While using credit cards to make purchases on things you can’t afford and will be unable to pay back isn’t a good method, leveraging debt is, especially when building wealth.

Leveraging Debt

Dasha fell into debt after going through a divorce. While she was always told not to depend on credit cards, it became her only way of survival. However, after going through that experience, she continues to share her story and provide tips on how to get out of consumer debt and use credit cards to your advantage.

“This is something that I've talked to my audience about as just a simple way to decide on leveraging debt, using debt in a way that is going to make you more money. So being in debt, whether it's you know, credit cards to pay for a class or a certification or you need to get financing for a car, like using debt in a way that is going to help you make more money in the long run,” she says.

“So then, as you make more money, you will want to be able to pay off, you know, the debt that you took on, and on top of that, your income as a whole would have increased. So that's one way to leverage debt to build wealth or money by taking care of things or expenses that you need that could catapult your career, help make, you know, income even it's like investing in like a small business that you want to do.”

“This is something that I've talked to my audience about as just a simple way to decide on leveraging debt, using debt in a way that is going to make you more money. So being in debt, whether it's you know, credit cards to pay for a class or a certification or you need to get financing for a car, like using debt in a way that is going to help you make more money in the long run.”

Research

DoubleAnti/ Getty Images

Debt specialist Natalia recommends that people put the same amount of effort into researching credit cards and debt as they do everything else. She explains by sharing something someone told her. “I used to do more research on a pair of shoes or you know, Amazon shopping like I go straight to the reviews and people do that without even thinking about it,” she says.

“You put a lot more effort into researching the things that you want when you're making a purchase; you can do the same exact thing with like Dasha said, is this credit card the right credit card for me? I drive a lot, so I should have a gas card, right, versus a points card because that doesn't transfer the gas, right? So, you should look at every single aspect of your life. And when you're getting to a point of using it (credit) as a tool, make sure it fits your lifestyle and do as much research as you would, you know, a new car or a wedding dress or whatever those important things are that you've done a lot of research in. You should do the same thing with your debt situation.”

Shift Your Mindset

“It was realizing what I was doing was not the right way. Because I was sticking to what I was told. And I was in a predicament, right? And there were some social pressures, right? You're supposed to do certain things as a woman,” she explains. “You're supposed to get married, have kids, and all these things, and I was following this traditional Caribbean path. That without all the right tools to understand what I needed to make that successful. So it was realizing, you know, if I keep going this way, it's only gonna get worse. So I have to do something different.

“And it was that moment that I decided just like Dasha said, to not be ashamed of it, not to hide it. I made a pact with myself. It was actually 12 years ago; it popped up on my Facebook memories where it said I'm gonna change my life this year. And I just focused on that any way that I could. I made mistakes along the way, but I learned that you know, you learn from mistakes. You can't do everything perfect. And over that year, I decided to change my life."

When she began working for NDR, she learned more about financial literacy, which further enhanced her journey. She also found out that she wasn’t alone and a lot of women are or have been in similar situations. She was no longer blaming herself for having debt and was finally letting go of the shame around it.

“It was realizing what I was doing was not the right way. Because I was sticking to what I was told. And I was in a predicament, right? And there were some social pressures, right? You're supposed to do certain things as a woman.”

Eleganza/ Getty Images

“That's actually when I started with NDR is when I decided to make that shift, right. And one of the myths I had to get over was it was my fault. It was not my fault. There are so many reasons that people end up in debt,” she says. “It could be medical, it could be a divorce, like Dasha. It could be, you know, just not having the financial education.

“At the time, it was not taught in schools, right? I just barely had a macroeconomics and a microeconomics class in college and it was only because I was in accounting that I knew how to balance a checkbook. So, it's one of those things where I just really had to let go the the shame of it, just like Dasha said, and move on, right, and take control and be confident or at least learn how to be confident as I got more knowledge.”

Finding Safe Spaces

As Dasha was learning more about financial literacy, she relied on community, particularly online. The self-proclaimed financial activist created The Broke Black Girl, which started off as a Facebook group and now has become a popular online destination that shares tips on saving, investing, building wealth, and much more.

“For me, when it came to shifting my mindset, it was finding community online, finding places that validated me. At the beginning, I had to create my own space because I didn't easily come across some that approach debt or just money as a whole in an empathetic way in an understanding, meeting you where you are type way, which is what led me to create The Broke Black Girl,” she explains.

“But then as you grow and you learn, and you find more resources, you find more communities, and I also mentioned like resources like NDR that understands that debt is not a morally wrong thing, it's not something that you should feel ashamed, excluded from having certain conversations about money and getting the help."

“But then as you grow and you learn, and you find more resources, you find more communities, and I also mentioned like resources like NDR that understands that debt is not a morally wrong thing, it's not something that you should feel ashamed, excluded from having certain conversations about money and getting the help."

She continues, “So, for me, when it came to the shift in my mindset, it was really finding communities and resources, and organizations that validated my experience. So before I could even start with any tools or tips, I needed someone to validate that I wasn't crazy, that I was making this up, and I think that was a huge play in me learning to look at debt and just money different as a whole.”

Natalia and Dasha are passionate about educating others on financial literacy. Through NDR and their personal efforts, they are hoping to make a positive impact in the lives of others and help them avoid the same mistakes they made. For more information about NDR, visit nationaldebtrelief.com.

Let’s make things inbox official! Sign up for the xoNecole newsletter for daily love, wellness, career, and exclusive content delivered straight to your inbox.

Feature image courtesy

Exclusive: Viral It Girl Kayla Nicole Is Reclaiming The Mic—And The Narrative

It’s nice to have a podcast when you’re constantly trending online. One week after setting timelines ablaze on Halloween, Kayla Nicole released an episode of her Dear Media pop culture podcast, The Pre-Game, where she took listeners behind the scenes of her viral costume.

The 34-year-old had been torn between dressing up as Beyoncé or Toni Braxton, she says in the episode. She couldn’t decide which version of Bey she’d be, though. Two days before the holiday, she locked in her choice, filming a short recreation of Braxton’s “He Wasn’t Man Enough for Me” music video that has since garnered nearly 6.5M views on TikTok.

Kayla Nicole says she wore a dress that was once worn by Braxton herself for the Halloween costume. “It’s not a secret Toni is more on the petite side. I’m obsessed with all 5’2” of her,” she tells xoNecole via email. “But I’m 5’10'' and not missing any meals, honey, so to my surprise, when I got the dress and it actually fit, I knew it was destiny.”

The episode was the perfect way for the multihyphenate to take control of her own narrative. By addressing the viral moment on her own platform, she was able to stir the conversation and keep the focus on her adoration for Braxton, an artist she says she grew up listening to and who still makes her most-played playlist every year. Elsewhere, she likely would’ve received questions about whether or not the costume was a subliminal aimed at her ex-boyfriend and his pop star fiancée. “I think that people will try to project their own narratives, right?” she said, hinting at this in the episode. “But, for me personally – I think it’s very important to say this in this moment – I’m not in the business of tearing other women down. I’m in the business of celebrating them.”

Kayla Nicole is among xoNecole’s It Girl 100 Class of 2025, powered by SheaMoisture, recognized in the Viral Voices category for her work in media and the trends she sets on our timelines, all while prioritizing her own mental and physical health. As she puts it: “Yes, I’m curating conversations on my podcast The Pre-Game, and cultivating community with my wellness brand Tribe Therepē.”

Despite being the frequent topic of conversation online, Kayla Nicole says she’s learning to take advantage of her growing social media platform without becoming consumed by it. “I refuse to let the internet consume me. It’s supposed to be a resource and tool for connection, so if it becomes anything beyond that I will log out,” she says.

On The Pre-Game, which launched earlier this year, she has positioned herself as listeners “homegirl.” “There’s definitely a delicate dance between being genuine and oversharing, and I’ve had to learn that the hard way. Now I share from a place of reflection, not reaction,” she says. “If it can help someone feel seen or less alone, I’ll talk about it within reason. But I’ve certainly learned to protect parts of my life that I cherish most. I share what serves connection but doesn’t cost me peace.

"I refuse to let the internet consume me. It’s supposed to be a resource and tool for connection, so if it becomes anything beyond that I will log out."

Credit: Malcolm Roberson

Throughout each episode, she sips a cocktail and addresses trending topics (even when they involve herself). It’s a platform the Pepperdine University alumnus has been preparing to have since she graduated with a degree in broadcast journalism, with a concentration in political science.

“I just knew I was going to end up on a local news network at the head anchor table, breaking high speed chases, and tossing it to the weather girl,” she says. Instead, she ended up working as an assistant at TMZ before covering sports as a freelance reporter. (She’s said she didn’t work for ESPN, despite previous reports saying otherwise.) The Pre-Game combines her love for pop culture and sports in a way that once felt inaccessible to her in traditional media.

She’s not just a podcaster, though. When she’s not behind the mic, taking acting classes or making her New York Fashion Week debut, Kayla Nicole is also busy elevating her wellness brand Tribe Therepē, where she shares her workouts and the workout equipment that helps her look chic while staying fit. She says the brand will add apparel to its line up in early 2026.

“Tribe Therepē has evolved into exactly what I have always envisioned. A community of women who care about being fit not just for the aesthetic, but for their mental and emotional well-being too. It’s grounded. It’s feminine. It’s strong,” she says. “And honestly, it's a reflection of where I am in my life right now. I feel so damn good - mentally, emotionally, and physically. And I am grateful to be in a space where I can pour that love and light back into the community that continues to pour into me.”

Tap into the full It Girl 100 Class of 2025 and meet all the women changing game this year and beyond. See the full list here.

Featured image by Malcolm Roberson

If there is one thing that I am going to do, it’s buy myself some scented soy candles. And, as I was looking at a display of them in a TJ Maxx store a couple of weekends ago, I found myself wondering just who decided which scents were considered to be “holiday” ones. The origin stories are actually pretty layered, so, for now, I’ll just share a few of ‘em.

I’m sure it’s pretty obvious that pine comes from the smell of fresh Christmas trees; however, scents like cloves, oranges, and cinnamon are attributed to two things: being natural ways to get well during the cold and flu season, and also being flavors that are used in many traditional holiday meals.

Meanwhile, frankincense and myrrh originate from the Middle East and Africa (you know, like the Bible does — some folks need to be reminded of that—eh hem — Trumpers) and ginger? It too helps with indigestion (which can definitely creep up at Thanksgiving and Christmas dinner tables); plus, it’s a key ingredient for ginger snaps and gingerbread houses. So, as you can see, holiday-themed scents have a rhyme and reason to them.

Tying this all in together — several years ago, I penned an article for the platform entitled, “Are You Ready To Have Some Very Merry ‘Christmas Sex’?” Well, in the spirit of revisiting some of that content, with a bit of a twist, I decided to broach some traditional holiday scents from the perspective of which ones will do your libido a ton of good from now through New Year’s Eve (check out “Make This Your Best NYE. For Sex. EVER.”).

Are you ready to check some of them out, so that, whether it’s via a candle, a diffuser, some essential oil, or some DIY body cream (check out “How To Incorporate All Five Senses To Have The Best Sex Ever”), you can bring some extra festive ambiance into your own boudoir? Excellent.

1. Vanilla

Unsplash

When it comes to holiday desserts, you’re going to be hard-pressed to find recipes that don’t include vanilla — and that alone explains why it is considered to be a traditional holiday scent. As far as your libido goes, vanilla is absolutely considered to be an aphrodisiac — partly because its sweet scent is considered to be very sensual. Some studies even reveal that vanillin (the active ingredient in vanilla) is able to increase sexual arousal and improve erectile dysfunction in men. So, if you adore the smell, here is more incentive to use it.

2. Frankincense

Unsplash

Although, typically, when people think about frankincense (and myrrh), it’s in the context of the gifts that the wise men brought Christ after he was born; it’s a part of the biblical Christmas story. However, frankincense goes much deeper than that. Sexually, since it has an earthy and spicy scent, some people like to use it to meditate (check out “What Exactly Is 'Orgasmic Meditation'?”). Also, since it has the ability to put you in a better mood, soothe and soften your skin and maintain your oral health — with the help of frankincense, every touch and kiss can be that much…sexier.

3. Cinnamon

Unsplash

I already gave cinnamon a shout-out in the intro. Personally, I’ve been a fan of it, in the sex department, for a long time now (check out “12 ‘Sex Condiments’ That Can Make Coitus Even More...Delicious”). When it’s in oil form, it can be very sweet to the taste while sending a warm sensation throughout the body — which is why the giver and receiver of oral sex can benefit from its usage. Beyond that, cinnamon helps to increase blood flow to your genital region, elevate sexual desire and, some studies say that it can even help improve fertility. Beautiful.

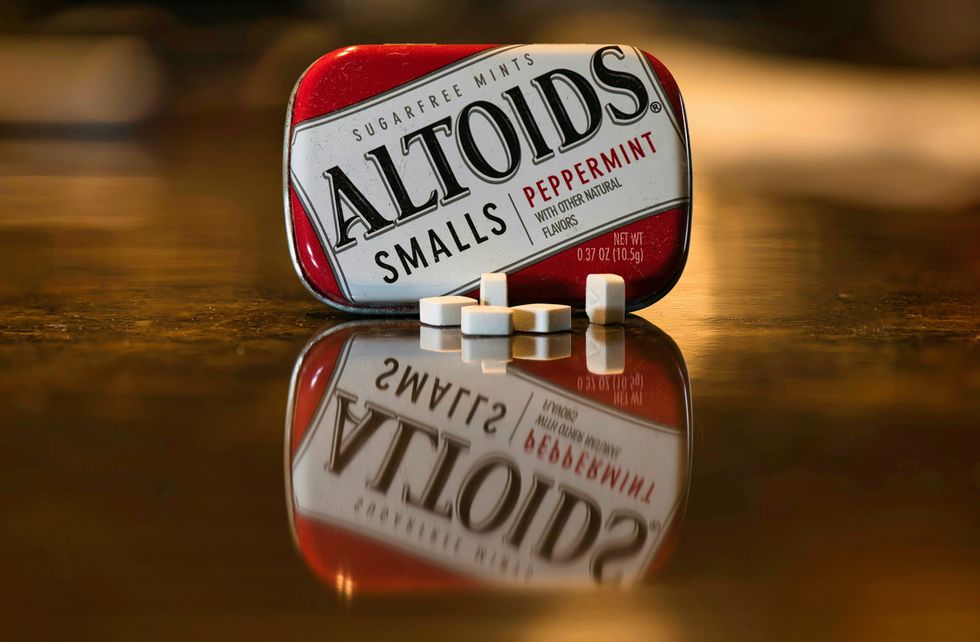

4. Peppermint

Unsplash

If there’s a signature candy for the holiday season, it’s probably a candy cane — which automatically puts peppermint in the running for being an official holiday scent. Pretty much, in any form, it’s got your sex life’s back because it’s hailed as being a sexual stimulant; in part, because its smell is so invigorating. Plus, it helps to (eh hem) ease headaches, it gives you more energy and it can definitely help to freshen your breath. Also, that minty sensation? The same thing that I said about cinnamon can apply to peppermint too (if you catch my drift).

5. Ginger

Unsplash

Whether it’s in a meal or in your bedroom, ginger is going to produce results that are hella spicy. On the sex tip, science has praised ginger for being able to increase sexual arousal, improve blood circulation (which intensifies orgasms) and strengthen fertility for many years. Scent-wise, I find it to be one that both men and women enjoy because it is both woodsy and sweet. So, if you’ve got some massage oil in mind, adding some ginger is a way to please you both.

6. Pomegranate

Unsplash

September through December is the time of year when pomegranates are considered to be in season. And, as someone who is a Rosh Hashanah observer, I have a personal adoration for them because I am aware of the various things that they symbolize in Hebrew culture including the fact that they are a fruit that represents love and fertility. So yeah, they would absolutely be an aphrodisiac — one that is perfect for this time of the year. While consuming it helps to boost testosterone levels in both men and women, the floral bittersweet smell that it produces can help to reduce stress while promoting relaxation (like most floral scents do) — and the more relaxed you are, the easier it is to climax.

7. Nutmeg

Unsplash

Another signature seasoning during the holiday season is nutmeg. It’s perfect in Thanksgiving sweet potato (or pumpkin) pie and Christmas morning French toast. And yes, it can also make your sex life better. If you consume it, it can intensify your libido and, overall, its warm-meets-spicy-meets-sweet smell is so inviting that it is considered to be a pretty seductive scent.

8. Cloves

Unsplash

I ain’t got not one lie to tell you — if you’ve got a toothache, put some clove oil on that bad boy and send me a Christmas present for putting you on game. Aside from that, as I round all of this out, cloves are another holiday scent that can do wonders for your sex life. For men, it has the ability to significantly increase sexual arousal and improve stamina and endurance. For men and women alike, it also has a reputation for strengthening sexual desire. And for women solely? Well, if you want an all-natural way to increase natural lubrication down below — the scent and and feel (in DILUTED oil form) can make that happen. It can make the holidays especially special…if you know what I mean.

Ah yes — the atmosphere of the holidays and what it can do.

Take it all in! Scent ‘n whatever stimulating that comes with it! #wink

Let’s make things inbox official! Sign up for the xoNecole newsletter for love, wellness, career, and exclusive content delivered straight to your inbox.

Featured image by Giphy