In case no one has told you yet, you are a business. So often, people make the mistake of believing that they can only treat their lives like a business if they are an entrepreneur or a business owner, not realizing that the mere fact that they exist in this world makes them an owned and operated business. And as such, everything you do can be written off as an expense and thus, add to your overall wealth.

At least, that's what Dr. Lynn Richardson will put you on game about.

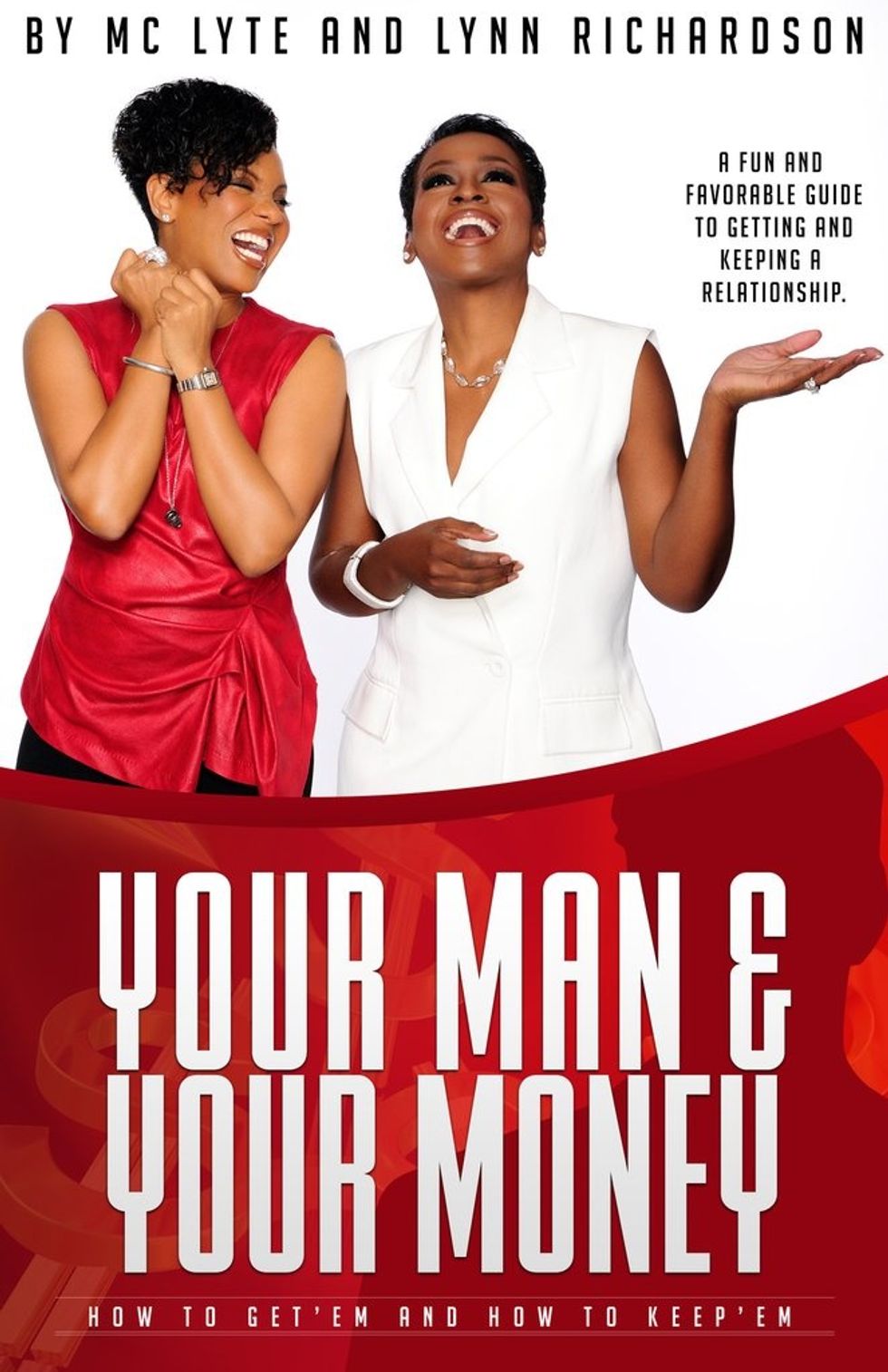

The financial expert and life coach took the stage on Saturday afternoon (July 28) during a conversation orchestrated by P&G's My Black Is Beautiful in partnership with the National Underground Railroad Freedom Center and Greater Cincinnati Association of Black Journalists. Famed rapper and humanitarian MC Lyte took the stage as the event's keynote speaker, and revealed her seven-year friendship with Lynn, as well as the fact that they partnered together in their book, Your Man and Your Money: How to Get'em and How to Keep'em. The two met when MC was really lost about how to have her finances together and as her financial advisor, Lynn pulled her through, and even helped her triple her income in the process!

There, the two friends and collaborators talked all things financial literacy, being your own business, and entrepreneurial advancement. And xoNecole was there to collect all of the gems. Read on for more.

Apply the 10-10-30-50 Rule to Your Budget

While many of us out there who have dabbled or are experts in budgeting know the power of a good dose of the 50-20-30 rule, Lynn's modified 10-10-30-50 rule might be the key to unlocking a lot of our financial success. "The first 10 percent you tithe, the next 10 percent you save. Our grandmas taught us to save for a rainy day, but really, we have to save for a come up. That means, when we have the opportunity to invest in something, [we can invest]," Lynn explained. "When the stock market crashed in 2008, everyone was in a recession. Well, one of my sorors, and financial mentors, she had saved and had money that she could use to invest, and she did. When the stocks went down to 20 cents a share, she bought 100,000 shares. And when it went back up to $12 a share, she sold it."

"We have to save for a come up."

She continued, "The next 30 percent is cash. And cash is what we have to understand as entrepreneurs. People on this planet have figured out how they can go into the boardroom, create something that cost $2 that they can sell to us on Black Friday for $250 and make it feel like we have to have it. Having cash prevents you from having a spending addiction… The remaining 50 percent stays in your checking account to go to bills."

Use Only 30% of Your Income as Spending Money

When breaking down the 10-10-30-50 rule for budgeting, the 30 percent allocated to cash plays a very major role in your day to day spending. Unlike the 50 percent for your bills that stays in your checking account, the 30 percent is to act as cash that you carry around and takes care of everything, from your nail appointment to your groceries.

Some of us (especially those of us who have a spending addiction) might think that relying on 30 percent and carrying it around in cash isn't feasible. If you ask Lynn, you're thinking way too small. And those extra unnecessary expenses? You need to cut it.

"What happens is, we forget that we spend mindlessly. And it's not about not having the intelligence, it's us rejecting what the world says that we have to do with our money and make a decision. That's where I say women, especially women of color, we can be billionaires, but we cannot ignore the basic thing we learned in the first grade, and that's mathematics: 1 + 1 equals 2. And if your stuff adds up to 10, it will never get to 2. And we will always be trying to figure out how to make our money work and where is it going."

"Control that number, and we can control our wealth."

Take Advantage of Everyday Expenses During Tax Time

What many of us fail to realize is how much we stand to gain during tax time by writing off expenses and deducting properly. Lynn wants everyone to be empowered by the fact that simply by existing, they are a fully owned and operated business. This does not mean quitting your job, but for all intents and purposes, you are an entrepreneur, whether you realize it or not. Therefore, it's time you start deducting like it.

"If you have a business and your business makes $100,000, here's what happens to all of your income: first, you get to expense everything you use in your business. You get to expense your cell phone. You get to expense your mileage or your gas on your car. You get to expense your trips because when you go on trips - I don't care if it's a family trip or a vacation or a family reunion in Mississippi - you are actually on a business trip so you need to expense that. Once you expense everything, they'll say, 'Those expenses are $65,000, there's $35,000 left over. That's the amount you get taxed on.'"

Lynn also suggested that wealthy people don't necessarily have more money, they just know how to get their money back. As an entrepreneur, it's crucial that we view ourselves as a business and view everything we do as a potential expense to be a tax write off.

Invest in Strategic Multiple Streams of Income

For most people, the secret to acquiring wealth is never allowing one hat to be your only hat and by that I mean, having multiple streams of income. Along with cultivating different avenues where more money can easily travel, it is important to develop strategy when diversifying your income as well, which is also where a strong personal brand comes into play. Whether it's a brick and mortar, selling or doing hair, repurposing vintage clothes, or mixing up your own beauty line, the opportunities are there, you just have to take it. "Multiple streams of income give us the ability to extinguish the fiery darts of an unstable economy. So, if one of your businesses is no longer popular, you got seven more to look at," Lynn added.

"We've got to have multiple streams of income, but we also gotta have strategy."

It is important to diversify your income in order to maximize your wealth potential, but it is also important to know that while more money is great to have, having the financial literacy to navigate your finances adeptly and strategically is ultimately the golden rule in acquiring wealth and breaking ground for more black women business owners, entrepreneurs, and millionaires. "Black women, we are the most educated people on the planet. There is no group of people who have more degrees than black women," Lynn noted. "We have PhD's, Master's degrees, and MBA's. But one of the things that sits with me a lot, is why are we not as wealthy as our education says? We are last on the totem pole when it comes to wealth."

And it's time that changes.

Featured image by Kathy Hutchins / Shutterstock.com

- 042: Running Your Family Like a Business and Getting on Top of Life ›

- Why I Run My Household Like a Business (and You Should Too ... ›

- This column will change your life: running your family like a business ... ›

- The Personal Business Plan: A Blueprint for Running Your Life ... ›

- Run Your Life like a Business – Thomas Chen – Medium ›

- Why To Run Your Life, Like a Business ›

- 7 Ways To Run Your Life Like A Business - AskMen ›

- Why you should run your life like a business ~ Get Rich Slowly ›

- Here's What Happened When I Started Running My Life Like a ... ›